Your one-stop shop for news, views and getting clues. I AM YOUR INFORMATION FILTER, since 2006.

Wednesday, June 30, 2010

Bloomberg: U.S. banks financing Mexico's drug cartels

Monday, June 28, 2010

SEND REINFORCEMENTS! Only 2,000 U.S. to 1 al Qaeda in Afghanistan

Now experts are saying there are probably fewer than 50 and no more than 100 al Qaeda members in Afghanistan! In fact, they're not there at all, they're in western Pakistan.

Meanwhile, Obama gave McChrystal most of what he wanted, with almost 98,000 troops on the ground, more than Dubya ever sent.

So, now we have a maximum ratio of almost 2,000 U.S. troops in Afghanistan for every 1 member of al Qaeda there; and a minimum of about 1,000 to 1.

You know, that sounds like enough troops to do the job. In fact, that sounds like way too many troops to do the job. No more al Qaeda in Afghanistan even kind of sounds like, well, "Mission Accomplished," doesn't it? I mean, put this in perspective: we can't restrict the flow of millions of Mexicans into the U.S., but we've managed to root out all but 50 al Qaeda from a country that's not even ours, with a border that nobody controls. I say it's time to pat each other on the back, give ourselves a laurel and a hearty handshake and say, "See ya, Afghanistan!" Let's bring our victorious troops home to a big hoopla parade! Whoopee! WE WON!!!!

What?... nobody else is excited? Nobody does an endzone dance anymore? What's wrong with you people?

Yeah, well, the truth, as we all know -- what neither Obama nor Dubya will admit -- is that we are not at war; we are an occupier stuck doing nation-building in Afghanistan. Our happenstance enemy there is the Taliban, who never threatened or attacked the United States until we invaded their country and took them out of power. To keep them out of power, we have to simultaneously (1) provide security against their harsh rule and retribution against cooperating Afghans, and (2) give the people "government in a box," as McChrystal put it, so that they don't look to said Taliban to provide freedom from chaos. Only thing is, that box with shiny wrapping and a pretty bow on top is empty. There's no such thing as government in a box. And even if there were, we've chosen the hardest place on earth to start a new government: a primitive, forbidding, uneducated, dirt poor, xenophobic, heavily armed, devoutly Islamic population with no history of democracy, power-to-the-people or rational civilized discourse. These are backward village idiots and crazy goat herders of the highest order. (No disrespect intended: all 3 major religions originated with such folk; so if God loves them so should we.)

Our task there is akin to convincing the majority of rural Mississipians or Alabamans -- by giving them the equivalent of 2-3x their average income in cash and in-kind -- to become slick, multicultural, gentrified, fast-talking New Yorkers and never revert to their poor, redneck ways once our support ends. They've tried this on Wife Swap a hundred times already and it's never worked.

Leon Panetta: There May Be Less Than 50 Al Qaeda Fighters In Afghanistan

June 27, 2010 | AP/Huffington Post

URL: http://www.huffingtonpost.com/2010/06/27/leon-panetta-there-may-be_n_627012.html

Sunday, June 27, 2010

Big Oil defeated new safety rules before BP explosion

James Woolsey: 'Destroy oil as a strategic commodity'

Saturday, June 26, 2010

Wilkerson on Cheney's gutting of oil regulation, etc.

Ratigan: Financial reform law is 'window dressing'

BP spill is a teachable moment

Friday, June 25, 2010

Ratigan: Walking away from an underwater mortgage is 'pure capitalism'

Sunday, June 20, 2010

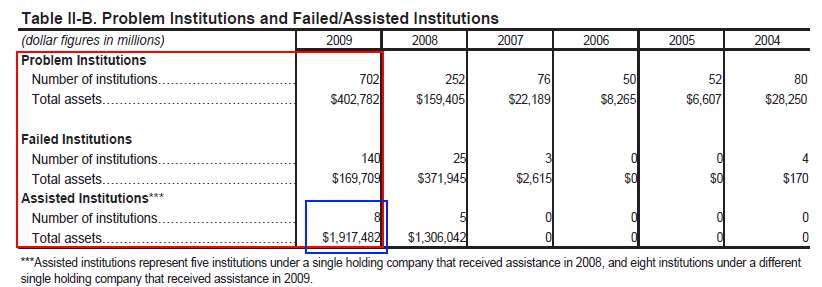

MB360: FDIC insolvent, hungry for taxpayers' $$$

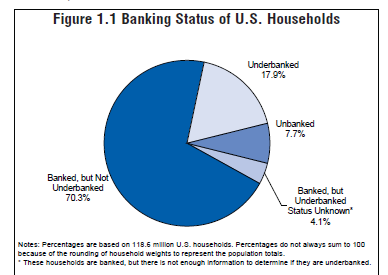

" A substantial percentage of lower-income households are unbanked. Nearly 20 percent of lower income U.S. households—almost 7 million households earning below $30,000 per year—do not currently have a bank account. Households with earnings below $30,000 account for at least 71 percent of unbanked households.Not having enough money to feel they need an account is the most common reason why unbanked households are not participating in the mainstream financial system."

"(Fed history) From December 1912 to December 1913, the Glass-Willis proposal was hotly debated, molded and reshaped. By December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law, it stood as a classic example of compromise—a decentralized central bank that balanced the competing interests of private banks and populist sentiment."

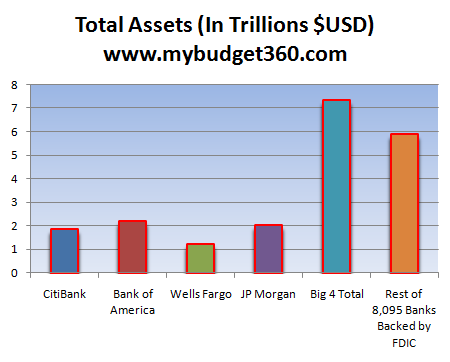

"The top 4 banks of Bank of America, JP Morgan Chase, Wells Fargo, and Citibank make up 55 percent of all banking assets."

Foreclosures remain at record levels and this means banks are facing more and more loans that enter into default. This costs money. As we have mentioned, the FDIC is insolvent so where is this money coming from?"(US Banker) Treasury likes it, the Federal Deposit Insurance Corp. likes it, and the banking industry likes it—that is, S. 541, introduced last week by Sen. Chris Dodd (D-Conn.) The bill would permanently increase the FDIC's ability to borrow from the Treasury for its Deposit Insurance Fund, raising the cap to $100 billion from $30 billion, the limit set back in 1991. The Depositor Protection Act would also temporarily allow the FDIC to borrow up to $500 billion after consultations with Treasury, the Federal Reserve, and the President.FDIC chairman Sheila Bair voiced enthusiasm in a letter to Dodd, noting "the FDIC believes it is prudent to adjust the statutory line of credit proportionally to leave no doubt that the FDIC can immediately access the necessary resources to resolve failing banks and provide timely protection to insured depositors." Passage of the increased borrowing ability "would give the FDIC flexibility to reduce the size of the recent special assessment, while still maintaining assessments at a level that supports the DIF with industry funding."

Cheney killed the Gulf from beyond the grave

American Conservative: Helen Thomas a victim of PC

Johns Hopkins: Cat people are schizo

Saturday, June 19, 2010

GAO probe vindicates ACORN

Obama is a great celebrity, but poor leader

Friday, June 18, 2010

Vile Reaganism in easy-to-digest chart form

Reagan Revolution Home To Roost -- In Charts

By Dave Johnson

June 15, 2010 - 10:46am ET

It seems that you can look at a chart of almost anything and right around 1981 or soon after you'll see the chart make a sharp change in direction, and probably not in a good way. And I really do mean almost anything, from economics to trade to infrastructure to ... well almost anything. I spent some time looking for charts of things, and here are just a few examples. In each of the charts below look for the year 1981, when Reagan took office.

Conservative policies transformed the United States from the largest creditornation to the largest debtor nation in just a few years, and it has only gotten worse since then:

And forced working people to spend down savings to get by:

Which forced working people to go into debt: (total household debt as percentage of GDP)

None of which has helped economic growth much: (12-quarter rolling average nominal GDP growth.)

Please leave a comment pointing people to a chart with a change after Reagan took office. How about a chart that shows America's investment in maintaining and modernizing our infrastructure over time?

Sometimes it can be so obvious where a problem comes from, but very hard to change it. The anti-government, pro-corporate-rule Reagan Revolution screwed a lot of things up for regular people and for the country. Some of this disaster we saw happening at the time and some of it has taken 30 years to become clear. But for all the damage done these "conservative" policies greatly enriched a few entrenched interests, who use their wealth and power to keep things the way they are. And the rest of us, hit so hard by the changes, don't have the resources to fight the wealth and power. (Speaking of which, you can donate to CAF here.)

Look at the influence of these entrenched interests on our current deficits, for example. Obviously conservative policies of tax cuts and military spending increases caused the massive deficits. But entrenched interests use their wealth and power to keep us from making needed changes. The facts are here, plain as the noses on our faces. The ability to fight it eludes us. Will we step up and do something to reverse the disaster caused by the Reagan Revolution or not?

Reagan Revolution Home To Roost: America Drowning In Debt Reagan Revolution Home To Roost: America Is Crumbling Finance, Mine, Oil & Debt Disasters: THIS Is Deregulation

Monday, June 14, 2010

FOX: Does Obama hate America?