Your one-stop shop for news, views and getting clues. I AM YOUR INFORMATION FILTER, since 2006.

Wednesday, February 29, 2012

Slimeball Jamie Dimon: Reporters are overpaid

U.S. bank profits hit 5-year high -- YAY BAILOUTS!

10% of Wall St. bankers are psychopaths

Tuesday, February 28, 2012

Studies: Wealth makes us worse human beings

Buffett has skin in the housing game

Buffett: High corporate taxes in U.S. a 'myth'

Republicans rightly fear the End Times

Monday, February 27, 2012

Facebook's IPO, income, and users' privacy

"Researchers at Polytechnic Institute of New York University tracked the privacy settings of 1.4 million Facebook profiles belonging to New Yorkers over a 15-month period between March 2010 and June 2011. They found a 'dramatic decrease in the amount of information Facebook users reveal about themselves to the general public' and the authors concluded that the users became 'dramatically more private' during the period, according to their report."Over the same period, users stepped up the frequency with which they hid personal details in their public profiles, which are visible to anyone on Facebook, a friend or otherwise. To measure this, the researchers tracked nine characteristics often included on public profiles -- 'friend lists, age, high-school name and graduation year, network, relationship, gender, interested in, hometown and current city' -- and monitored whether members shared fewer details over time."

Saturday, February 25, 2012

Fun with words: DOHS

Taibbi: GOP makes 'circular firing squad' for lack of targets

"This is where the Republican Party is now. They've run out of foreign enemies to point fingers at. They've already maxed out the rhetoric against us orgiastic, anarchy-loving pansexual liberal terrorists. The only possible remaining explanation for their troubles is that their own leaders have failed them. There is a stranger in the house!"This current race for the presidential nomination has therefore devolved into a kind of Freudian Agatha Christie story, in which the disturbed and highly paranoid voter base by turns tests the orthodoxy of each candidate, trying to figure out which one is the spy, which one is really Barack Obama bin Laden-Marx under the candidate mask![...]"These people have run out of others to blame, run out of bystanders to suspect, run out of decent family people to dismiss as Godless, sex-crazed perverts. They're turning the gun on themselves now. It might be justice, or it might just be sad. Whatever it is, it's remarkable to watch."

GOP plans would blow up national debt

Treasonous U.S. politicians outsourcing war decision to Israel

Glenn Beck's Goldline forced to refund $4.5 M... What about Beck?

Wednesday, February 22, 2012

Obama wants to cut corp. tax rate to 28%

Tuesday, February 21, 2012

Drug testing for welfare recipients and clash of conservative values

In the case of drug testing for welfare recipients, it's a case of spending way more money on testing than can be saved by excluding drug abusers from welfare.

For example, since Florida mandated testing of welfare recipients last year, only 2 percent have failed the tests. Florida has had to eat the costs of tests for the 96 percent who passed.

But don't hold your breath waiting for Florida to cancel expensive drug testing. This is a case where conservatives want government to spend a lot of money to promote their values.

UPDATE (02.25.2012): GOP primary candidate Mitt Romney said that drug testing for welfare recipients was an "excellent idea," damn the costs. So there you go.

Commentary: Drug testing welfare recipients is a waste of taxpayers' money

By Mary Sanchez

February 20, 2012 | Kansas City Star

URL: http://www.mcclatchydc.com/2012/02/20/139081/commentary-drug-testing-welfare.html#storylink=cpy

Ring of 450 U.S. military bases threatened by Iran

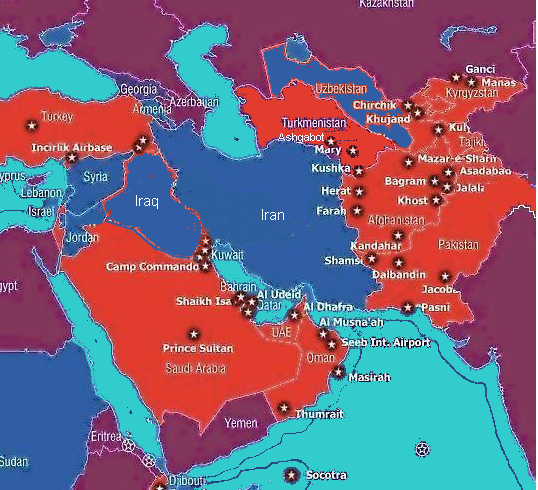

His title looks like a typo.

Indeed, Iran is a threat to the U.S., because it can hardly spit in any direction without hitting a U.S. military base.

Ring of Iranian Bases Threatens US

By Juan Cole

February 18, 2012 | juancole.com

I had grabbed an earlier version of this graphic off a Democratic Underground bulletin board from 2005. It made the point that the United States, which professes itself menaced by Iran, rather has Iran encircled by military bases. I have tried to update the map a bit, though this area is a moving target and the map no doubt isn't perfect. It is expressive enough, however, of the reality. Iraq and Uzbekistan no longer have American bases, but the US military now has a refueling station in Turkmenistan.

Some critics complained that forward operating bases are not much of a base. But actually, this map vastly understates the case. It shows only a few of the estimated 450 US military bases and outposts in Afghanistan, e.g. And it does not show drone bases, of which the US has 60 around the world.

Iran has 150 billion barrels in petroleum reserves, among the largest reserves in the world, but they cannot be exploited by US corporations because of Israel lobby-inspired US congressional sanctions on Iran. US elites, especially Big Oil, dream of doing regime change in Iran so as to get access to those vast reserves. Likely the most important US objection to the Iranian civilian nuclear enrichment program is that it could give Iran "nuclear latency," the ability to construct a bomb quickly if it seemed to Tehran that the US planned to attack. That is, the real objection in Washington to Iranian nuclear know-how is that it makes Iraq-style regime change impossible and so puts Iranian petroleum out of reach of Houston for the foreseeable future. This consideration is likely the real reason that Washington does not, so to speak, go ballistic about North Korea and Pakistan having actual nuclear warheads, but like to has a fainting spell at the very idea of Iran enriching uranium to 3.5 percent (a bomb takes 95%). North Korea and Pakistan don't have oil.

Krugman: Fiscal austerity is all pain, no gain

Monday, February 20, 2012

EU's fanatical 'saviors' destroying Greece, EU

"The EU's terms do not begin to match the altruism the United States showed to the defeated Germans after 1945.... Greece has invaded no one and committed no crimes against humanity. Yet the EU, which boasts that solidarity is its founding principle, is forcing it into destitution and chaos."

KY bill to end phone service to rural areas

Facebook too shall pass

Sunday, February 19, 2012

Father of classical physics was alchemist, end-times freak

Friday, February 17, 2012

Renting beats owning '100 percent of the time'

Obama campaign promises 'not to make Wall St. look bad'

Megadeth for Santorum!

Thursday, February 16, 2012

German linguists can't do without 's**tstorm'

UPDATE (07.09.2013): Here's the latest on shitty German lexicography: "The German Dictionary Has A New Fun Word, Thanks To The Internet And The Eurozone Crisis." Apparently shitstorm (Scheißesturm?) is one of Merkel's favorite words.

Romney a hypocrite, poor businessman in opposing auto rescue

Military-corporate welfare grants NH town a tank

Obama: Healthcare fraud buster-in-chief

Health Care Fraud Judgments: Federal Authorities Recovered $4.1 Billion In 2011

By Kelli Kennedy

February 13, 2012 | Huffington Post

URL: http://www.huffingtonpost.com/2012/02/14/health-care-fraud-judgment_n_1275320.html

GOP's demented 'oldthink' on U.S. nuke stockpile

Congressional Republicans just blow my mind. How can they Obama's call to reduce our nuclear stockpile to "only" a few hundred nuclear warheads "unilateral disarmament" when Russia is poised to follow suit, and when the the country they say we should be arming ourselves against, Iran, doesn't have even one nuclear weapon yet??

This is old, Cold-War thinking ingrained so deep it can't be excised. It is like a tumor causing dementia in their rotting brains. These old dinosaurs just need to crawl away from Washington and die in a bog somewhere.

Obama Administration's Proposed Nuclear Weapons Cuts Attacked By House GOP

By Donna Cassatta and Robert Burns

February 15, 2012 | Huffington Post

URL: http://www.huffingtonpost.com/2012/02/15/obama-nuclear-weapons-cuts-house-gop_n_1279946.html

Tuesday, February 14, 2012

Why does America lock so many people up?

"More than half of all black men without a high-school diploma go to prison at some time in their lives. Mass incarceration on a scale almost unexampled in human history is a fundamental fact of our country today—perhaps the fundamental fact, as slavery was the fundamental fact of 1850. In truth, there are more black men in the grip of the criminal-justice system—in prison, on probation, or on parole—than were in slavery then. Over all, there are now more people under 'correctional supervision' in America—more than six million—than were in the Gulag Archipelago under Stalin at its height. That city of the confined and the controlled, Lockuptown, is now the second largest in the United States."The accelerating rate of incarceration over the past few decades is just as startling as the number of people jailed: in 1980, there were about two hundred and twenty people incarcerated for every hundred thousand Americans; by 2010, the number had more than tripled, to seven hundred and thirty-one. No other country even approaches that. In the past two decades, the money that states spend on prisons has risen at six times the rate of spending on higher education."

"Prison rape is so endemic—more than seventy thousand prisoners are raped each year—that it is routinely held out as a threat, part of the punishment to be expected. The subject is standard fodder for comedy, and an uncoöperative suspect being threatened with rape in prison is now represented, every night on television, as an ordinary and rather lovable bit of policing. The normalization of prison rape—like eighteenth-century japery about watching men struggle as they die on the gallows—will surely strike our descendants as chillingly sadistic, incomprehensible on the part of people who thought themselves civilized."

"'American prisons trace their lineage not only back to Pennsylvania penitentiaries but to Texas slave plantations.' White supremacy is the real principle, this thesis holds, and racial domination the real end. In response to the apparent triumphs of the sixties, mass imprisonment became a way of reimposing Jim Crow. Blacks are now incarcerated seven times as often as whites. 'The system of mass incarceration works to trap African Americans in a virtual (and literal) cage,' the legal scholar Michelle Alexander writes. Young black men pass quickly from a period of police harassment into a period of 'formal control' (i.e., actual imprisonment) and then are doomed for life to a system of 'invisible control.' Prevented from voting, legally discriminated against for the rest of their lives, most will cycle back through the prison system. The system, in this view, is not really broken; it is doing what it was designed to do. Alexander's grim conclusion: 'If mass incarceration is considered as a system of social control—specifically, racial control—then the system is a fantastic success.'"

"It's hard to imagine any greater disconnect between public good and private profit: the interest of private prisons lies not in the obvious social good of having the minimum necessary number of inmates but in having as many as possible, housed as cheaply as possible. No more chilling document exists in recent American life than the 2005 annual report of the biggest of these firms, the Corrections Corporation of America. Here the company (which spends millions lobbying legislators) is obliged to caution its investors about the risk that somehow, somewhere, someone might turn off the spigot of convicted men:

"'Our growth is generally dependent upon our ability to obtain new contracts to develop and manage new correctional and detention facilities. . . . The demand for our facilities and services could be adversely affected by the relaxation of enforcement efforts, leniency in conviction and sentencing practices or through the decriminalization of certain activities that are currently proscribed by our criminal laws. For instance, any changes with respect to drugs and controlled substances or illegal immigration could affect the number of persons arrested, convicted, and sentenced, thereby potentially reducing demand for correctional facilities to house them.'"

"In the nineties, the N.Y.P.D. began to control crime not by fighting minor crimes in safe places but by putting lots of cops in places where lots of crimes happened— 'hot-spot policing.' The cops also began an aggressive, controversial program of 'stop and frisk'— 'designed to catch the sharks, not the dolphins,' as Jack Maple, one of its originators, described it—that involved what's called pejoratively 'profiling.' This was not so much racial, since in any given neighborhood all the suspects were likely to be of the same race or color, as social, involving the thousand small clues that policemen recognized already. Minority communities, [researcher Franklin E.] Zimring emphasizes, paid a disproportionate price in kids stopped and frisked, and detained, but they also earned a disproportionate gain in crime reduced. 'The poor pay more and get more' is Zimring's way of putting it."

"Zimring said, in a recent interview, 'Remember, nobody ever made a living mugging. There's no minimum wage in violent crime.' In a sense, he argues, it's recreational, part of a life style: 'Crime is a routine behavior; it's a thing people do when they get used to doing it.' And therein lies its essential fragility. Crime ends as a result of 'cyclical forces operating on situational and contingent things rather than from finding deeply motivated essential linkages.' Conservatives don't like this view because it shows that being tough doesn't help; liberals don't like it because apparently being nice doesn't help, either. Curbing crime does not depend on reversing social pathologies or alleviating social grievances; it depends on erecting small, annoying barriers to entry."

"'New York City, in the midst of a dramatic reduction in crime, is locking up a much smaller number of people, and particularly of young people, than it was at the height of the crime wave,' Zimring observes. Whatever happened to make street crime fall, it had nothing to do with putting more men in prison."

"...since prison plays at best a small role in stopping even violent crime, very few people, rich or poor, should be in prison for a nonviolent crime. Neither the streets nor the society is made safer by having marijuana users or peddlers locked up, let alone with the horrific sentences now dispensed so easily. For that matter, no social good is served by having the embezzler or the Ponzi schemer locked in a cage for the rest of his life, rather than having him bankrupt and doing community service in the South Bronx for the next decade or two."

"To read the literature on crime before it dropped is to see the same kind of dystopian despair we find in the new literature of punishment: we'd have to end poverty, or eradicate the ghettos, or declare war on the broken family, or the like, in order to end the crime wave. The truth is, a series of small actions and events ended up eliminating a problem that seemed to hang over everything. There was no miracle cure, just the intercession of a thousand smaller sanities. Ending sentencing for drug misdemeanors, decriminalizing marijuana, leaving judges free to use common sense (and, where possible, getting judges who are judges rather than politicians)—many small acts are possible that will help end the epidemic of imprisonment as they helped end the plague of crime."

U.S. spending power won't come back

Monday, February 13, 2012

MB360: United States of Dollar Stores

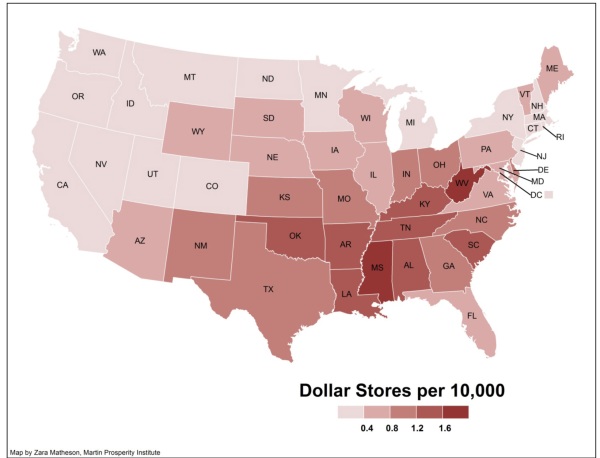

Before 2000 dollar stores were largely seen as a bazaar of quirky trinkets and plastic oddities. Many sold excess volume of products, even selling old Super Bowl t-shirts of teams that did not win. Yet the dollar store of today is not the one of even one decade ago. The disillusionment of the middle class and the rise of a low-wage American worker base have created a booming business for dollar stores. Customers from more affluent backgrounds are now shopping at these stores because of an economic caution about their declining purchasing power. Even in the midst of the boom in the stock market we still have over 45,000,000+ Americans receiving food assistance. I talked about this large segment of our population in EBT Nation. What does the rise of the dollar store tell us about the future of the American economy?

Dollar Store growth

Dollar stores have been around for many decades but the surge in big name dollar stores really hit a full head of steam once the recession arrived:

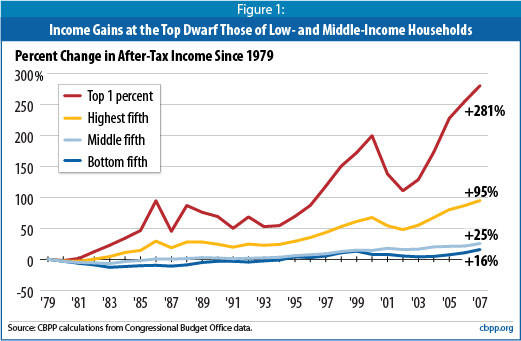

You can see that the two leading dollar stores, Dollar General and Family Dollar hit full stride after 2008. This is a billion dollar business that is benefitting from the weakness in the overall economy. As more income is concentrated in fewer hands, the middle class gets squeezed down and with trillion dollar bailouts targeted at the financial sector, many Americans are seeing their purchasing power dwindle. Yet this compression is not felt as heavily at dollar stores where many can live large with a declining dollar, even if it is only for a brief shopping experience.

Part of this growth also comes from our persistently high unemployment rate:

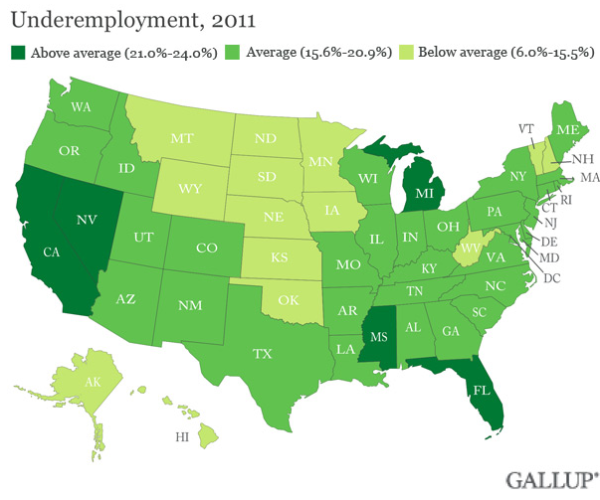

5 states still have underemployment rates that are above 20 percent. So even though jobs are being added many are being added in lower-wage service sector fields. 5 million good paying jobs were lost since the recession hit and only about 1 million have been recovered.

Impact of compressing middle class on dollar stores

One of the surprising trends with dollar store growth comes from more affluent Americans becoming customers:

"(NY Times) Financial anxiety — or the New Consumerism, if you like — has been a boon to dollar stores. Same-store sales, a key measure of a retailer's health, spiked at the three large, publicly traded chains in this year's first quarter — all were up by at least 5 percent — while Wal-Mart had its eighth straight quarterly decline. Dreiling says that much of Dollar General's growth is generated by what he calls "fill-in trips" — increasingly made by wealthier people. Why linger in the canyons of Wal-Mart or Target when you can pop into a dollar store? Dreiling says that 22 percent of his customers make more than $70,000 a year and added, "That 22 percent is our fastest-growing segment."

I found this trend intriguing but this stems from the fact that most average Americans are seeing a compression to their real wage growth:

The fastest growing segment of dollar store customers are coming from those making $70,000 a year or more. In fact, 1 out of 5 dollar store shoppers come from this group. Keep in mind the median household income in the US is $50,000 and those that make $70,000 a year or more are in the top 35 percent of households.

This also plays into the reality of those lower-wage service sector jobs being added:

"This growth has led to a building campaign. At a time when few businesses seem to be investing in new equipment or ventures or jobs, Dreiling's company announced a few months ago that it would be creating 6,000 new jobs by building 625 new stores this year. Kiley Rawlins, vice president for investor relations at Family Dollar, said her company would add 300 new stores this year, giving it more than 7,000 in 44 states."

If you look at where dollar stores are most prevalent you will find them all across the country but they are most prevalent in the South:

The rise of the dollar store goes hand and hand with the loss of the middle class in America. The largest customers at dollar stores are still those with lower incomes, households making $40,000 a year or less make up nearly half the customer base. But when this pool continues to grow you have business growth and that is what we are seeing here. The average per capita income in the US is $25,000 which doesn't go far given the cost of healthcare, energy, and education.

It is also fascinating to see that 40 to 45 percent of dollar store items now come from big name brand companies. This industry is now a multi-billion dollar industry. I've driven around and see Subway and KFC for example now having marketing material showing "EBT accepted here" and dollar stores with a large and growing segment of their aisles made up of by food, are seeing a boon in this economy. I mean think about it with 45,000,000+ Americans receiving food assistance this is a large customer base. You also have many retirees who heavily rely only on Social Security stretching their declining buying power at these stores. Even with low profit margins business can be good. Not sure if we should be thrilled that dollar stores are one business segment that is booming in our modern day economy.