You lib'ruls will be with me on this, you don't need any convincing, you just need to know the "high-finance" mechanics of how greedy, lawless Wall Street SOBs used Big Guvmint not only to save themselves, but to become more profitable than ever in the face of a collapsing financial system. You know instinctively that Wall Street's recent profits stink to high heaven, but you have to educate yourselves on how they accomplished it.It's you "pro-business" Republicans and teabaggers who need more convincing, although you Tea Partiers are ostensibly opposed to all bailouts, albeit the relatively measly bailouts of GM and Chrysler seem to rankle you much more, for the reason that Detroit has labor unions, whereas hotshot investment banks turned bank holding companies sucking from the Fed's teat interest-free didn't automatically raise any ideological red flags with you rubes. Do you suffer from what con men call "True Believer Syndrome"?Read it and weep, you marks. Then get mad as hell. And then do something about it. Yes, Obama and Geithner have oodles of blame. Get over it. You're not voting for Democrats anyway. That's not a cure. The point is to fix it. Contact your Congressmen. Tell them you won't tolerate being robbed! Re-establishing Glass-Steagall would be a damn good start!Wall Street's Bailout Hustle Goldman Sachs and other big banks aren't just pocketing the trillions we gave them to rescue the economy - they're re-creating the conditions for another crashBy Matt Taibbi

February 17, 2010 Rolling Stone

On January 21st, Lloyd Blankfein left a peculiar voicemail message on the work phones of his employees at Goldman Sachs. Fast becoming America's pre-eminent Marvel Comics supervillain, the CEO used the call to deploy his secret weapon: a pair of giant, nuclear-powered testicles. In his message, Blankfein addressed his plan to pay out gigantic year-end bonuses amid widespread controversy over Goldman's role in precipitating the global financial crisis.

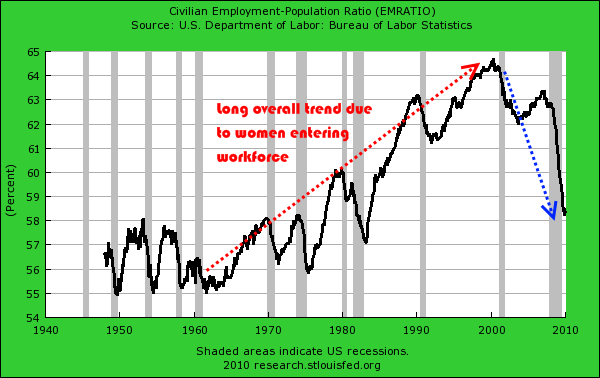

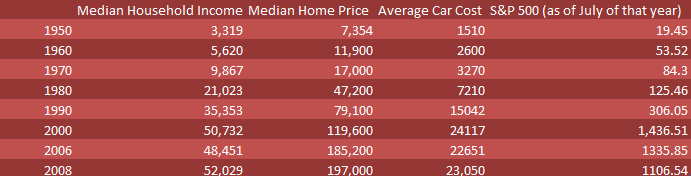

The bank had already set aside a tidy $16.2 billion for salaries and bonuses — meaning that Goldman employees were each set to take home an average of $498,246, a number roughly commensurate with what they received during the bubble years. Still, the troops were worried: There were rumors that Dr. Ballsachs, bowing to political pressure, might be forced to scale the number back. After all, the country was broke, 14.8 million Americans were stranded on the unemployment line, and Barack Obama and the Democrats were trying to recover the populist high ground after their bitch-whipping in Massachusetts by calling for a "bailout tax" on banks. Maybe this wasn't the right time for Goldman to be throwing its annual Roman bonus orgy.

Not to worry, Blankfein reassured employees. "In a year that proved to have no shortage of story lines," he said, "I believe very strongly that performance is the ultimate narrative."

Translation: We made a shitload of money last year because we're so amazing at our jobs, so fuck all those people who want us to reduce our bonuses.

Goldman wasn't alone. The nation's six largest banks — all committed to this balls-out, I drink your milkshake! strategy of flagrantly gorging themselves as America goes hungry — set aside a whopping $140 billion for executive compensation last year, a sum only slightly less than the $164 billion they paid themselves in the pre-crash year of 2007. In a gesture of self-sacrifice, Blankfein himself took a humiliatingly low bonus of $9 million, less than the 2009 pay of elephantine New York Knicks washout Eddy Curry. But in reality, not much had changed.

"What is the state of our moral being when Lloyd Blankfein taking a $9 million bonus is viewed as this great act of contrition, when every penny of it was a direct transfer from the taxpayer?" asks Eliot Spitzer, who tried to hold Wall Street accountable during his own ill-fated stint as governor of New York.

Beyond a few such bleats of outrage, however, the huge payout was met, by and large, with a collective sigh of resignation. Because beneath America's populist veneer, on a more subtle strata of the national psyche, there remains a strong temptation to not really give a shit. The rich, after all, have always made way too much money; what's the difference if some fat cat in New York pockets $20 million instead of $10 million?

The only reason such apathy exists, however, is because there's still a widespread misunderstanding of how exactly Wall Street "earns" its money, with emphasis on the quotation marks around "earns." The question everyone should be asking, as one bailout recipient after another posts massive profits — Goldman reported $13.4 billion in profits last year, after paying out that $16.2 billion in bonuses and compensation — is this: In an economy as horrible as ours, with every factory town between New York and Los Angeles looking like those hollowed-out ghost ships we see on History Channel documentaries like Shipwrecks of the Great Lakes, where in the hell did Wall Street's eye-popping profits come from, exactly? Did Goldman go from bailout city to $13.4 billion in the black because, as Blankfein suggests, its "performance" was just that awesome?

A year and a half after they were minutes away from bankruptcy, how are these assholes not only back on their feet again, but hauling in bonuses at the same rate they were during the bubble?The answer to that question is basically twofold:

They raped the taxpayer, and they raped their clients.

The bottom line is that banks like Goldman have learned absolutely nothing from the global economic meltdown. In fact, they're back conniving and playing speculative long shots in force — only this time with the full financial support of the U.S. government. In the process, they're rapidly re-creating the conditions for another crash, with the same actors once again playing the same crazy games of financial chicken with the same toxic assets as before.

That's why this bonus business isn't merely a matter of getting upset about whether or not Lloyd Blankfein buys himself one tropical island or two on his next birthday. The reality is that the post-bailout era in which Goldman thrived has turned out to be a chaotic frenzy of high-stakes con-artistry, with taxpayers and clients bilked out of billions using a dizzying array of old-school hustles that, but for their ponderous complexity, would have fit well in slick grifter movies like The Sting and Matchstick Men. There's even a term in con-man lingo for what some of the banks are doing right now, with all their cosmetic gestures of scaling back bonuses and giving to charities.

In the grifter world, calming down a mark so he doesn't call the cops is known as the "Cool Off."To appreciate how all of these (sometimes brilliant) schemes work is to understand the difference between earning money and taking scores, and to realize that

the profits these banks are posting don't so much represent national growth and recovery, but something closer to the losses one would report after a theft or a car crash. Many Americans instinctively understand this to be true — but, much like when your wife does it with your 300-pound plumber in the kids' playroom, knowing it and actually watching the whole scene from start to finish are two very different things. In that spirit, a brief history of the best 18 months of grifting this country has ever seen:

CON #1 THE SWOOP AND SQUATBy now, most people who have followed the financial crisis know that

the bailout of AIG was actually a bailout of AIG's "counterparties" — the big banks like Goldman to whom the insurance giant owed billions when it went belly up.What is less understood is that the bailout of AIG counter-parties like Goldman and Société Générale, a French bank, actually began before the collapse of AIG, before the Federal Reserve paid them so much as a dollar. Nor is it understood that

these counterparties actually accelerated the wreck of AIG in what was, ironically, something very like the old insurance scam known as "Swoop and Squat," in which a target car is trapped between two perpetrator vehicles and wrecked, with the mark in the game being the target's insurance company — in this case, the government.This may sound far-fetched, but the financial crisis of 2008 was very much caused by a perverse series of legal incentives that often made failed investments worth more than thriving ones. Our economy was like a town where everyone has juicy insurance policies on their neighbors' cars and houses. In such a town, the driving will be suspiciously bad, and there will be a lot of fires.

AIG was the ultimate example of this dynamic. At the height of the housing boom,

Goldman was selling billions in bundled mortgage-backed securities — often toxic crap of the no-money-down, no-identification-needed variety of home loan — to various institutional suckers like pensions and insurance companies, who frequently thought they were buying investment-grade instruments. At the same time, in a glaring example of the perverse incentives that existed and still exist, Goldman was also betting against those same sorts of securities — a practice that one government investigator compared to "selling a car with faulty brakes and then buying an insurance policy on the buyer of those cars."

Goldman often "insured" some of this garbage with AIG, using a virtually unregulated form of pseudo-insurance called credit-default swaps. Thanks in large part to deregulation pushed by Bob Rubin, former chairman of Goldman, and Treasury secretary under Bill Clinton, AIG wasn't required to actually have the capital to pay off the deals. As a result,

banks like Goldman bought more than $440 billion worth of this bogus insurance from AIG, a huge blind bet that the taxpayer ended up having to eat.

Thus, when the housing bubble went crazy, Goldman made money coming and going. They made money selling the crap mortgages, and they made money by collecting on the bogus insurance from AIG when the crap mortgages flopped.Still, the trick for Goldman was: how to collect the insurance money. As AIG headed into a tailspin that fateful summer of 2008, it looked like the beleaguered firm wasn't going to have the money to pay off the bogus insurance. So Goldman and other banks began demanding that AIG provide them with cash collateral. In the 15 months leading up to the collapse of AIG, Goldman received $5.9 billion in collateral. Société Générale, a bank holding lots of mortgage-backed crap originally underwritten by Goldman, received $5.5 billion.

These collateral demands squeezing AIG from two sides were the "Swoop and Squat" that ultimately crashed the firm. "It put the company into a liquidity crisis," says Eric Dinallo, who was intimately involved in the AIG bailout as head of the New York State Insurance Department.

It was a brilliant move. When a company like AIG is about to die, it isn't supposed to hand over big hunks of assets to a single creditor like Goldman; it's supposed to equitably distribute whatever assets it has left among all its creditors.

Had AIG gone bankrupt, Goldman would have likely lost much of the $5.9 billion that it pocketed as collateral. "Any bankruptcy court that saw those collateral payments would have declined that transaction as a fraudulent conveyance," says Barry Ritholtz, the author of

Bailout Nation.

Instead, Goldman and the other counterparties got their money out in advance — putting a torch to what was left of AIG. Fans of the movie Goodfellas will recall Henry Hill and Tommy DeVito taking the same approach to the Bamboo Lounge nightclub they'd been gouging. Roll the Ray Liotta narration: "Finally, when there's nothing left, when you can't borrow another buck . . . you bust the joint out. You light a match."

And why not? After all,

according to the terms of the bailout deal struck when AIG was taken over by the state in September 2008, Goldman was paid 100 cents on the dollar on an additional $12.9 billion it was owed by AIG — again, money it almost certainly would not have seen a fraction of had AIG proceeded to a normal bankruptcy.

Along with the collateral it pocketed, that's $19 billion in pure cash that Goldman would not have "earned" without massive state intervention. How's that $13.4 billion in 2009 profits looking now? And that doesn't even include the direct bailouts of Goldman Sachs and other big banks, which began in earnest after the collapse of AIG.

CON #2 THE DOLLAR STOREIn the usual "DollarStore" or "Big Store" scam — popularized in movies like The Sting — a huge cast of con artists is hired to create a whole fake environment into which the unsuspecting mark walks and gets robbed over and over again. A warehouse is converted into a makeshift casino or off-track betting parlor, the fool walks in with money, leaves without it.

The two key elements to the Dollar Store scam are the whiz-bang theatrical redecorating job and the fact that everyone is in on it except the mark. In this case, a pair of investment banks were dressed up to look like commercial banks overnight, and it was the taxpayer who walked in and lost his shirt, confused by the appearance of what looked like real Federal Reserve officials minding the store.

Less than a week after the AIG bailout, Goldman and another investment bank, Morgan Stanley, applied for, and received, federal permission to become bank holding companies — a move that would make them eligible for much greater federal support. The stock prices of both firms were cratering, and there was talk that either or both might go the way of Lehman Brothers, another once-mighty investment bank that just a week earlier had disappeared from the face of the earth under the weight of its toxic assets.

By law, a five-day waiting period was required for such a conversion — but the two banks got them overnight, with final approval actually coming only five days after the AIG bailout.

Why did they need those federal bank charters? This question is the key to understanding the entire bailout era — because this Dollar Store scam was the big one. Institutions that were, in reality, high-risk gambling houses were allowed to masquerade as conservative commercial banks.

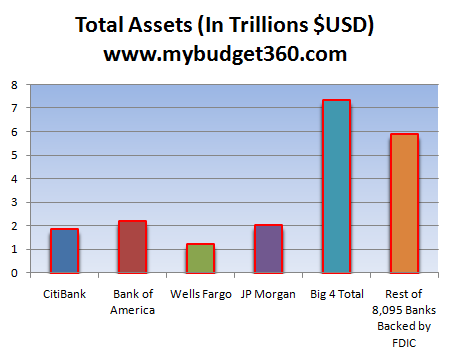

As a result of this new designation, they were given access to a virtually endless tap of "free money" by unsuspecting taxpayers. The $10 billion that Goldman received under the better-known TARP bailout was chump change in comparison to the smorgasbord of direct and indirect aid it qualified for as a commercial bank.When Goldman Sachs and Morgan Stanley got their federal bank charters, they joined Bank of America, Citigroup, J.P. Morgan Chase and the other banking titans who could go to the Fed and borrow massive amounts of money at interest rates that, thanks to the aggressive rate-cutting policies of Fed chief Ben Bernanke during the crisis, soon sank to zero percent.

The ability to go to the Fed and borrow big at next to no interest was what saved Goldman, Morgan Stanley and other banks from death in the fall of 2008. "They had no other way to raise capital at that moment, meaning they were on the brink of insolvency," says Nomi Prins, a former managing director at Goldman Sachs. "The Fed was the only shot."

In fact, the Fed became not just a source of emergency borrowing that enabled Goldman and Morgan Stanley to stave off disaster — it became a source of long-term guaranteed income. Borrowing at zero percent interest, banks like Goldman now had virtually infinite ways to make money.

In one of the most common maneuvers, they simply took the money they borrowed from the government at zero percent and lent it back to the government by buying Treasury bills that paid interest of three or four percent. It was basically a license to print money — no different than attaching an ATM to the side of the Federal Reserve.

"You're borrowing at zero, putting it out there at two or three percent, with hundreds of billions of dollars — man, you can make a lot of money that way," says the manager of one prominent hedge fund.

"It's free money." Which goes a long way to explaining Goldman's enormous profits last year. But all that free money was amplified by another scam:

CON #3 THE PIG IN THE POKEAt one point or another, pretty much everyone who takes drugs has been burned by this one, also known as the "Rocks in the Box" scam or, in its more elaborate variations, the "Jamaican Switch." Someone sells you what looks like an eightball of coke in a baggie, you get home and, you dumbass, it's baby powder.

The scam's name comes from the Middle Ages, when some fool would be sold a bound and gagged pig that he would see being put into a bag; he'd miss the switch, then get home and find a tied-up cat in there instead. Hence the expression "Don't let the cat out of the bag."

The "Pig in the Poke" scam is another key to the entire bailout era. After the crash of the housing bubble — the largest asset bubble in history — the economy was suddenly flooded with securities backed by failing or near-failing home loans. In the cleanup phase after that bubble burst, the whole game was to get taxpayers, clients and shareholders to buy these worthless cats, but at pig prices.

One of the first times we saw the scam appear was in September 2008, right around the time that AIG was imploding.

That was when the Fed changed some of its collateral rules, meaning banks that could once borrow only against sound collateral, like Treasury bills or AAA-rated corporate bonds, could now borrow against pretty much anything — including some of the mortgage-backed sewage that got us into this mess in the first place. In other words, banks that once had to show a real pig to borrow from the Fed could now show up with a cat and get pig money. "All of a sudden, banks were allowed to post absolute shit to the Fed's balance sheet," says the manager of the prominent hedge fund.

The Fed spelled it out on September 14th, 2008, when it changed the collateral rules for one of its first bailout facilities — the

Primary Dealer Credit Facility, or PDCF. The Fed's own write-up described the changes: "With the Fed's action, all the kinds of collateral then in use . . . including non-investment-grade securities and equities . . . became eligible for pledge in the PDCF."

Translation: We now accept cats.

The Pig in the Poke also came into play in April of last year, when Congress pushed a little-known agency called the Financial Accounting Standards Board, or FASB, to change the so-called "mark-to-market" accounting rules. Until this rule change, banks had to assign a real-market price to all of their assets. If they had a balance sheet full of securities they had bought at $3 that were now only worth $1, they had to figure their year-end accounting using that $1 value. In other words, if you were the dope who bought a cat instead of a pig, you couldn't invite your shareholders to a slate of pork dinners come year-end accounting time.

But last April, FASB changed all that.

From now on, it announced, banks could avoid reporting losses on some of their crappy cat investments simply by declaring that they would "more likely than not" hold on to them until they recovered their pig value. In short, the banks didn't even have to actually hold on to the toxic shit they owned — they just had to sort of promise to hold on to it.

That's why the "profit" numbers of a lot of these banks are really a joke. In many cases, we have absolutely no idea how many cats are in their proverbial bag.

What they call "profits" might really be profits, only minus undeclared millions or billions in losses."They're hiding all this stuff from their shareholders," says Ritholtz, who was disgusted that the banks lobbied for the rule changes. "Now, suddenly banks that were happy to mark to market on the way up don't have to mark to market on the way down."

CON #4 THE RUMANIAN BOXOne of the great innovations of Victor Lustig, the legendary Depression-era con man who wrote the famous "Ten Commandments for Con Men," was a thing called the "Rumanian Box." This was a little machine that a mark would put a blank piece of paper into, only to see real currency come out the other side. The brilliant Lustig sold this Rumanian Box over and over again for vast sums — but he's been outdone by the modern barons of Wall Street, who managed to get themselves a real Rumanian Box.

How they accomplished this is a story that by itself highlights the challenge of placing this era in any kind of historical context of known financial crime. What the banks did was something that was never — and never could have been — thought of before. They took so much money from the government, and then did so little with it, that the state was forced to start printing new cash to throw at them. Even the great Lustig in his wildest, horniest dreams could never have dreamed up this one.

The setup: By early 2009, the banks had already replenished themselves with billions if not trillions in bailout money. It wasn't just the $700 billion in TARP cash, the free money provided by the Fed, and the untold losses obscured by accounting tricks.

Another new rule allowed banks to collect interest on the cash they were required by law to keep in reserve accounts at the Fed — meaning the state was now compensating the banks simply for guaranteeing their own solvency.

And a new federal operation called the Temporary Liquidity Guarantee Program let insolvent and near-insolvent banks dispense with their deservedly ruined credit profiles and borrow on a clean slate, with FDIC backing. Goldman borrowed $29 billion on the government's good name, J.P. Morgan Chase $38 billion, and Bank of America $44 billion. "TLGP," says Prins, the former Goldman manager, "was a big one."

Collectively, all this largesse was worth

trillions. The idea behind the flood of money, from the government's standpoint, was to spark a national recovery: We refill the banks' balance sheets, and they, in turn, start to lend money again, recharging the economy and producing jobs. "The banks were fast approaching insolvency," says Rep. Paul Kanjorski, a vocal critic of Wall Street who nevertheless defends the initial decision to bail out the banks. "It was vitally important that we recapitalize these institutions."

But here's the thing.

Despite all these trillions in government rescues, despite the Fed slashing interest rates down to nothing and showering the banks with mountains of guarantees, Goldman and its friends had still not jump-started lending again by the first quarter of 2009. That's where those nuclear-powered balls of Lloyd Blankfein came into play, as Goldman and other banks basically threatened to pick up their bailout billions and go home if the government didn't fork over more cash — a lot more. "Even if the Fed could make interest rates negative, that wouldn't necessarily help," warned Goldman's chief domestic economist, Jan Hatzius. "We're in a deep recession mainly because the private sector, for a variety of reasons, has decided to save a lot more."

Translation: You can lower interest rates all you want, but we're still not fucking lending the bailout money to anyone in this economy.

Until the government agreed to hand over even more goodies, the banks opted to join the rest of the "private sector" and "save" the taxpayer aid they had received — in the form of bonuses and compensation.

The ploy worked. In March of last year, the Fed sharply expanded a radical new program called

quantitative easing, which effectively operated as a real-live Rumanian Box. The government put stacks of paper in one side, and out came $1.2 trillion "real" dollars.

The government used some of that freshly printed money to prop itself up by purchasing Treasury bonds — a desperation move, since Washington's demand for cash was so great post-Clusterfuck '08 that even the Chinese couldn't buy U.S. debt fast enough to keep America afloat. But

the Fed used most of the new cash to buy mortgage-backed securities in an effort to spur home lending — instantly creating a massive market for major banks.And what did the banks do with the proceeds? Among other things, they bought Treasury bonds, essentially lending the money back to the government, at interest. The money that came out of the magic Rumanian Box went from the government back to the government, with Wall Street stepping into the circle just long enough to get paid.

And once quantitative easing ends, as it is scheduled to do in March, the flow of money for home loans will once again grind to a halt. The Mortgage Bankers Association expects the number of new residential mortgages to plunge by 40 percent this year.

CON #5 THE BIG MITTAll of that Rumanian box paper was made even more valuable by running it through the next stage of the grift. Michael Masters, one of the country's leading experts on commodities trading, compares this part of the scam to the poker game in the Bill Murray comedy Stripes. "It's like that scene where John Candy leans over to the guy who's new at poker and says, 'Let me see your cards,' then starts giving him advice," Masters says. "He looks at the hand, and the guy has bad cards, and he's like, 'Bluff me, come on! If it were me, I'd bet everything!' That's what it's like. It's like they're looking at your cards as they give you advice."

In more ways than one can count, the economy in the bailout era turned into a "Big Mitt," the con man's name for a rigged poker game. Everybody was indeed looking at everyone else's cards, in many cases with state sanction. Only taxpayers and clients were left out of the loop.

At the same time the Fed and the Treasury were making massive, earthshaking moves like quantitative easing and TARP, they were also consulting regularly with private advisory boards that include every major player on Wall Street.

The Treasury Borrowing Advisory Committee has a J.P. Morgan executive as its chairman and a Goldman executive as its vice chairman, while the board advising the Fed includes bankers from Capital One and Bank of New York Mellon.

That means that, in addition to getting great gobs of free money, the banks were also getting clear signals about when they were getting that money, making it possible to position themselves to make the appropriate investments.One of the best examples of the banks blatantly gambling, and winning, on government moves was the

Public-Private Investment Program, or PPIP. In this bizarre scheme cooked up by goofball-geek Treasury Secretary Tim Geithner,

the government loaned money to hedge funds and other private investors to buy up the absolutely most toxic horseshit on the market — the same kind of high-risk, high-yield mortgages that were most responsible for triggering the financial chain reaction in the fall of 2008. These satanic deals were the basic currency of the bubble: Jobless dope fiends bought houses with no money down, and the big banks wrapped those mortgages into securities and then sold them off to pensions and other suckers as investment-grade deals. The whole point of the PPIP was to get private investors to relieve the banks of these dangerous assets before they hurt any more innocent bystanders.

But what did the banks do instead, once they got wind of the PPIP? They started buying that worthless crap again, presumably to sell back to the government at inflated prices! In the third quarter of last year, Goldman, Morgan Stanley, Citigroup and Bank of America combined to add $3.36 billion of exactly this horseshit to their balance sheets.This brazen decision to gouge the taxpayer startled even hardened market observers. According to Michael Schlachter of the investment firm Wilshire Associates,

it was "absolutely ridiculous" that the banks that were supposed to be reducing their exposure to these volatile instruments were instead loading up on them in order to make a quick buck. "Some of them created this mess," he said, "and they are making a killing undoing it."

CON #6 THE WIREHere's the thing about our current economy. When Goldman and Morgan Stanley transformed overnight from investment banks into commercial banks, we were told this would mean a new era of "significantly tighter regulations and much closer supervision by bank examiners," as

The New York Times put it the very next day. In reality, however, the conversion of Goldman and Morgan Stanley simply completed the dangerous concentration of power and wealth that began in 1999, when Congress repealed the Glass-Steagall Act — the Depression-era law that had prevented the merger of insurance firms, commercial banks and investment houses. Wall Street and the government became one giant dope house, where a few major players share valuable information between conflicted departments the way junkies share needles.

One of the most common practices is a thing called

front-running, which is really no different from the old "Wire" con, another scam popularized in The Sting. But instead of intercepting a telegraph wire in order to bet on racetrack results ahead of the crowd, what Wall Street does is make bets ahead of valuable information they obtain in the course of everyday business.

Say you're working for the commodities desk of a big investment bank, and a major client — a pension fund, perhaps — calls you up and asks you to buy a billion dollars of oil futures for them. Once you place that huge order, the price of those futures is almost guaranteed to go up. If the guy in charge of asset management a few desks down from you somehow finds out about that, he can make a fortune for the bank by betting ahead of that client of yours. The deal would be instantaneous and undetectable, and it would offer huge profits. Your own client would lose money, of course — he'd end up paying a higher price for the oil futures he ordered, because you would have driven up the price. But that doesn't keep banks from screwing their own customers in this very way.

The scam is so blatant that Goldman Sachs actually warns its clients that something along these lines might happen to them. In the disclosure section at the back of a research paper the bank issued on January 15th, Goldman advises clients to buy some dubious high-yield bonds while admitting that the bank itself may bet against those same shitty bonds. "Our salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients and our proprietary trading desks that reflect opinions that are contrary to the opinions expressed in this research," the disclosure reads.

"Our asset-management area, our proprietary-trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research."Banks like Goldman admit this stuff openly, despite the fact that there are securities laws that require banks to engage in "fair dealing with customers" and prohibit analysts from issuing opinions that are at odds with what they really think. And yet here they are, saying flat-out that they may be issuing an opinion at odds with what they really think. To help them screw their own clients, the major investment banks employ high-speed computer programs that can glimpse orders from investors before the deals are processed and then make trades on behalf of the banks at speeds of fractions of a second. None of them will admit it, but everybody knows what this computerized trading — known as "flash trading" — really is. "Flash trading is nothing more than computerized front-running," says the prominent hedge-fund manager. The SEC voted to ban flash trading in September, but five months later it has yet to issue a regulation to put a stop to the practice.

Over the summer, Goldman suffered an embarrassment on that score when one of its employees, a Russian named Sergey Aleynikov, allegedly stole the bank's computerized trading code. In a court proceeding after Aleynikov's arrest, Assistant U.S. Attorney Joseph Facciponti reported that "the bank has raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways."

Six months after a federal prosecutor admitted in open court that the Goldman trading program could be used to unfairly manipulate markets, the bank released its annual numbers. Among the notable details was the fact that

a staggering 76 percent of its revenue came from trading, both for its clients and for its own account. "That is much, much higher than any other bank," says Prins, the former Goldman managing director. "If I were a client and I saw that they were making this much money from trading, I would question how badly I was getting screwed."

Why big institutional investors like pension funds continually come to Wall Street to get raped is the million-dollar question that many experienced observers puzzle over. Goldman's own explanation for this phenomenon is comedy of the highest order. In testimony before a government panel in January, Blankfein was confronted about his firm's practice of betting against the same sorts of investments it sells to clients.

His response: "These are the professional investors who want this exposure." In other words, our clients are big boys, so screw 'em if they're dumb enough to take the sucker bets I'm offering.

CON #7 THE RELOADNot many con men are good enough or brazen enough to con the same victim twice in a row, but the few who try have a name for this excellent sport: reloading. The usual way to reload on a repeat victim (called an "addict" in grifter parlance) is to rope him into trying to get back the money he just lost. This is exactly what started to happen late last year.

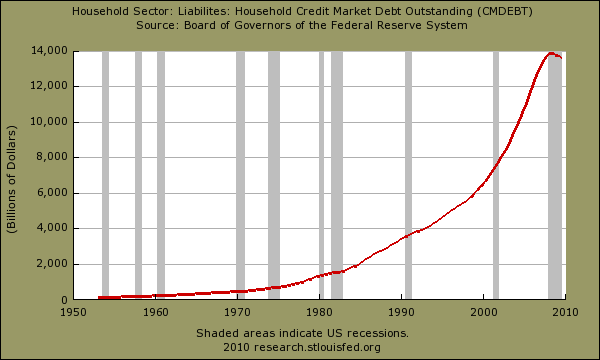

It's important to remember that the housing bubble itself was a classic confidence game — the

Ponzi scheme. The Ponzi scheme is any scam in which old investors must be continually paid off with money from new investors to keep up what appear to be high rates of investment return.

Residential housing was never as valuable as it seemed during the bubble; the soaring home values were instead a reflection of a continual upward rush of new investors in mortgage-backed securities, a rush that finally collapsed in 2008. But by the end of 2009, the unimaginable was happening: The bubble was re-inflating. A bailout policy that was designed to help us get out from under the bursting of the largest asset bubble in history inadvertently produced exactly the opposite result, as all that government-fueled capital suddenly began flowing into the most dangerous and destructive investments all over again. Wall Street was going for the reload.

A lot of this was the government's own fault, of course. By slashing interest rates to zero and flooding the market with money, the Fed was replicating the historic mistake that Alan Greenspan had made not once, but twice, before the tech bubble in the early 1990s and before the housing bubble in the early 2000s.

By making sure that traditionally safe investments like CDs and savings accounts earned basically nothing, thanks to rock-bottom interest rates, investors were forced to go elsewhere to search for moneymaking opportunities.Now we're in the same situation all over again, only far worse. Wall Street is flooded with government money, and interest rates that are not just low but flat are pushing investors to seek out more "creative" opportunities. (It's "Greenspan times 10," jokes one hedge-fund trader.) Some of that money could be put to use on Main Street, of course, backing the efforts of investment-worthy entrepreneurs. But that's not what our modern Wall Street is built to do. "They don't seem to want to lend to small and medium-sized business," says Rep. Brad Sherman, who serves on the House Financial Services Committee.

"What they want to invest in is marketable securities. And the definition of small and medium-sized businesses, for the most part, is that they don't have marketable securities. They have bank loans."In other words, unless you're dealing with the stock of a major, publicly traded company, or a giant pile of home mortgages, or the bonds of a large corporation, or a foreign currency, or oil futures, or some country's debt, or anything else that can be rapidly traded back and forth in huge numbers, factory-style, by big banks, you're not really on Wall Street's radar.

So with small business out of the picture, and the safe stuff not worth looking at thanks to the Fed's low interest rates, where did Wall Street go? Right back into the shit that got us here.

One trader, who asked not to be identified, recounts a story of what happened with his hedge fund this past fall. His firm wanted to short — that is, bet against — all the crap toxic bonds that were suddenly in vogue again. The fund's analysts had examined the fundamentals of these instruments and concluded that they were absolutely not good investments.

So they took a short position. One month passed, and they lost money. Another month passed — same thing. Finally, the trader just shrugged and decided to change course and buy.

"I said, 'Fuck it, let's make some money,'" he recalls. "I absolutely did not believe in the fundamentals of any of this stuff. However, I can get on the bandwagon, just so long as I know when to jump out of the car before it goes off the damn cliff!"This is the very definition of bubble economics — betting on crowd behavior instead of on fundamentals. It's old investors betting on the arrival of new ones, with the value of the underlying thing itself being irrelevant. And this behavior is being driven, no surprise, by the biggest firms on Wall Street.

The research report published by Goldman Sachs on January 15th underlines this sort of thinking. Goldman issued a strong recommendation to buy exactly the sort of high-yield toxic crap our hedge-fund guy was, by then, driving rapidly toward the cliff. "Summarizing our views," the bank wrote, "we expect robust flows . . . to dominate fundamentals." In other words: This stuff is crap, but everyone's buying it in an awfully robust way, so you should too. Just like tech stocks in 1999, and mortgage-backed securities in 2006.

To sum up, this is what Lloyd Blankfein meant by "performance": Take massive sums of money from the government, sit on it until the government starts printing trillions of dollars in a desperate attempt to restart the economy, buy even more toxic assets to sell back to the government at inflated prices — and then, when all else fails, start driving us all toward the cliff again with a frank and open endorsement of bubble economics. I mean, shit — who wouldn't deserve billions in bonuses for doing all that?

Con artists have a word for the inability of their victims to accept that they've been scammed. They call it the

"True Believer Syndrome." That's sort of where we are, in a state of nagging disbelief about the real problem on Wall Street. It isn't so much that we have inadequate rules or incompetent regulators, although both of these things are certainly true. The real problem is that

it doesn't matter what regulations are in place if the people running the economy are rip-off artists. The system assumes a certain minimum level of ethical behavior and civic instinct over and above what is spelled out by the regulations. If those ethics are absent — well, this thing isn't going to work, no matter what we do. Sure, mugging old ladies is against the law, but it's also easy. To prevent it, we depend, for the most part, not on cops but on people making the conscious decision not to do it.

That's why the biggest gift the bankers got in the bailout was not fiscal but psychological. "The most valuable part of the bailout," says Rep. Sherman, "was the implicit guarantee that they're Too Big to Fail." Instead of liquidating and prosecuting the insolvent institutions that took us all down with them in a giant Ponzi scheme, we have showered them with money and guarantees and all sorts of other enabling gestures. And what should really freak everyone out is the fact that Wall Street immediately started skimming off its own rescue money.

If the bailouts validated anew the crooked psychology of the bubble, the recent profit and bonus numbers show that the same psychology is back, thriving, and looking for new disasters to create. "It's evidence," says Rep. Kanjorski, "that they still don't get it."

More to the point, the fact that we haven't done much of anything to change the rules and behavior of Wall Street shows that we still don't get it. Instituting a bailout policy that stressed recapitalizing bad banks was like the addict coming back to the con man to get his lost money back. Ask yourself how well that ever works out. And then get ready for the reload.

[From Issue 1099 — March 4, 2010]