Your one-stop shop for news, views and getting clues. I AM YOUR INFORMATION FILTER, since 2006.

Monday, December 27, 2010

U.S. youth too fat & dumb to get hit by IEDs in Afghan. & Iraq

Nearly 1 in 4 fails military exam

December 22, 2010 | AP

URL: http://www.google.com/hostednews/ap/article/ALeqM5jmflKFlGubkYUuLnntRO-rOuuNRw?docId=c90a31f788054427ab6f7176f6c1d4c9

Tuesday, December 21, 2010

'Unregulated' internet: Per-service, per-page fees

Friday, December 17, 2010

Another victim of BHO-GOP tax deal: U.S. foreign aid

Yep, now we gotta trim the fat to pay for those tax cuts.

Obama is such an amateur. He should have seen this coming: first the Republicans run up the deficit with tax cuts on the rich, then they preach about cutting spending on worthwhile programs to close the budget gap. But they trim the fat oh-so selectively. They tell the rank-and-file they're "starving the beast," but it's just a pretext to cut unwanted programs while leaving others untouched.

Furthermore, Rep. Ros-Lehtinen made her foreign policy priorities clear: shunning, threatening, and sanctioning other nations, including Cuba, Iran, and North Korea:

"My worldview is clear: isolate and hold our enemies accountable, while supporting and strengthening our allies," she said. "I support strong sanctions and other penalties against those who aid violent extremists, brutalize their own people, and have time and time again rejected calls to behave as responsible nations. Rogue regimes never respond to anything less than hardball."

Ros-Lehtinen: My mission is to cut the State and foreign aid budgets

By Josh Rogin

December 8, 2010 The Cable

Thursday, December 16, 2010

Poll: Americans trust Obama slightly more than GOP

WR Pitt: Sanders' words for the ages, down the well

Wall St. bonuses could have financed all U.S. mortgage modifications

December 15, 2010 | Huffington Post

IRS audits up by 11%; richest targeted

MB360: Wall St. flush while middle class disappears

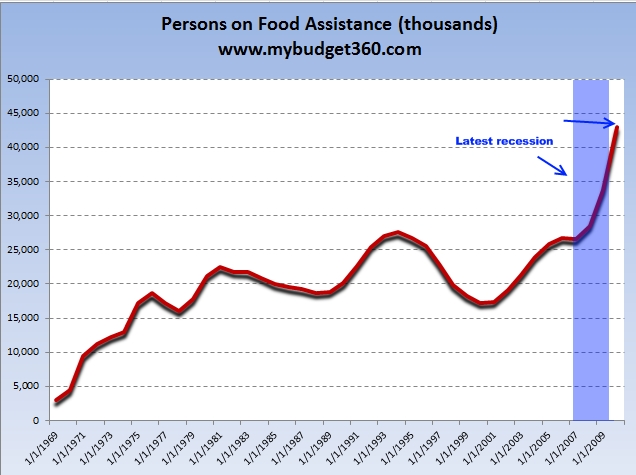

You will notice that from 2000 onward the growth in food assistance participation has shot directly up:

'Technical' party in U.S. mirrors Russia

This NYT story is about one woman in Siberia from a technical party who went rogue. Not in a Palin way, but in a real way. She wanted her technical party to be a real opposition. And Putin's ruling party, United Russia, reacted fiercely to her impudence.

Somewhat similarly, we have in the U.S. today a technical party called the Tea Party, which was established and funded by Republicans like Dick Armey and the Koch brothers to create the appearance of dissent/competition in the GOP ranks and to distract conservatives from the fact that their party supported the Wall Street bailouts, which the rank-and-file opposed.

Time will tell if this technical party will rise up against its master, the GOP, and seek to become a real alternative. But signs so far are not encouraging. So far it looks like this tactic straight out of Vladimir Putin's playbook has worked as intended: it got the GOP re-elected.

December 10, 2010 | New York Times

Monday, December 13, 2010

Poll: 70% of Americans wants to tax Wall St. to death

December 13, 2010 | Bloomberg

Hitchens: Beck's paranoia worse than Birchers'

By Christopher Hitchens

January 2011 issue | Vanity Fair

The more one looks at this, the more wrong it becomes (as does that giveaway phrase "responsible-seeming"). The John Birch Society possessed such a mainstream message—the existence of a Communist world system with tentacles in the United States—that it had a potent influence over whole sections of the Republican Party. It managed this even after its leader and founder, Robert Welch, had denounced President Dwight D. Eisenhower as a "dedicated, conscious agent" of that same Communist apparatus. Right up to the defeat of Barry Goldwater in 1964, and despite the efforts of such conservatives as William F. Buckley Jr. to dislodge them, the Birchers were a feature of conservative politics well beyond the crackpot fringe.

Now, here is the difference. Glenn Beck has not even been encouraging his audiences to reread Robert Welch. No, he has been inciting them to read the work of W. Cleon Skousen, a man more insane and nasty than Welch and a figure so extreme that ultimately even the Birch-supporting leadership of the Mormon Church had to distance itself from him. It's from Skousen's demented screed The Five Thousand Year Leap (to a new edition of which Beck wrote a foreword, and which he shoved to the position of No. 1 on Amazon) that he takes all his fantasies about a divinely written Constitution, a conspiratorial secret government, and a future apocalypse. To give you a further idea of the man: Skousen's posthumously published book on the "end times" and the coming day of rapture was charmingly called The Cleansing of America. A book of his with a less repulsive title, The Making of America, turned out to justify slavery and to refer to slave children as "pickaninnies." And, writing at a time when the Mormon Church was under attack for denying full membership to black people, Skousen defended it from what he described as this "Communist" assault.

Friday, December 10, 2010

Pew poll: Twitter is dumb

If you subtracted Kim Kardashian and the people following her tweets and commenting on her tweets and cross-posting her tweets, I bet that number would go down to about 1 percent.

The truth is that Twitter is ideal for people who have a hard time using up all 140 characters allowed.

Back in my day we blogged and sent e-mails, and by gum, we liked it!

Eight Percent of Americans Use Twitter

By Adrian Chen

December 10, 2010 | Gawker.com

URL: http://gawker.com/5711522/eight-percent-of-internet-users-tweet

Obama ad: Tax cuts no longer offend his conscience?

This damning ad will air in Indiana where Obama originally made this speech.

Now, by contrast, Obama is calling the continuation of Bush's tax cuts -- even on those who make more than $1 million a year -- a "good deal" for America.

What a spineless wimp!

MB360: Beyond TBTF: The era of mega banks

Posted by mybudget360

December 8, 2010

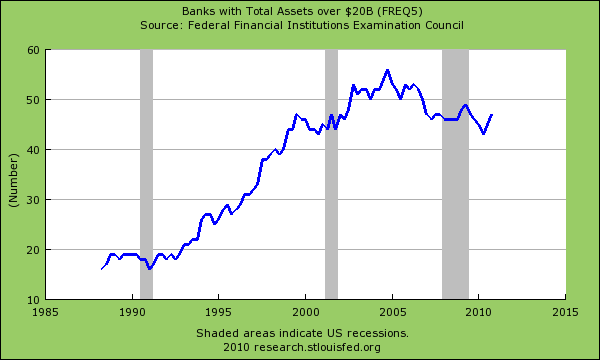

The growth of the too big to fail bank is something that is modern to this era. In the 1990s there were fewer than 40 institutions that had total assets above $20 billion. In the late part of the 1980s and 1990s this number was below 20. The peak was reached in 2005 with 55 institutions having more than $20 billion in total assets. That number has fallen in recent years because of the crisis yet we have a handful of banks that control most of the nation's banking assets. The total U.S. banking system as of today supports over $13 trillion in total assets. The FDIC insures these deposits with a deposit fund that is negative so it might as well be supported by pure faith. What makes up most of these assets are residential and commercial real estate loans. As we have discussed banks have yet to come to terms with the reality that many of these loans are not worth what they claim they are. First, let us look at the growth of too big to fail.

The chart is unmistakable in the modern era growth of mega banks:

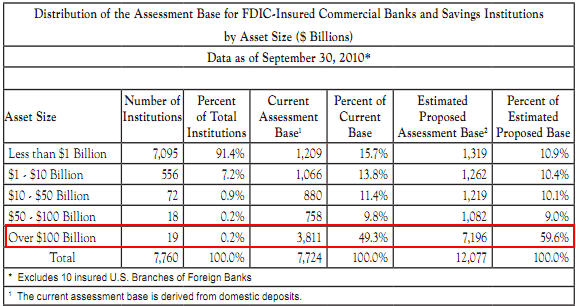

You can see that in the mid-1990s the growth in too big to fail took off. It hit its pinnacle in 2005. There is nothing inherently good about massively giant institutions and we have seen the ramifications of failure with Lehman Brothers and Bear Stearns to mention a couple notable collapses. Even though the U.S. banking system has 7,760 banks 19 banks make up 50 percent of the asset base:

Source: FDIC

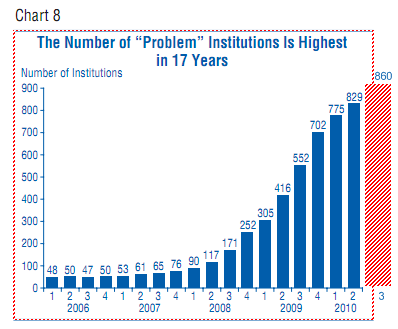

The more disturbing thing is that most of the bigger banks are the institutions with the weaker balance sheets. But look at the above chart. 7,095 banks can completely fail and only 15 percent of the total asset base would disappear. It shouldn't be surprising that the list of troubled smaller banks is growing:

But didn't you say smaller banks were doing better than bigger banks? They are for the most part but many of these smaller banks don't have the same kind of relationship with the Federal Reserve and don't have the leverage of say a JP Morgan or Bank of America. Looking at recent banking profits the bulk of the money being made isn't on a strong U.S. bank customer, but by speculating through their investment units around the world. This can take the form of speculating in commodities, stocks in emerging countries, or anything else. When you can borrow at zero percent it isn't too difficult to turn a profit but it is certainly not benefitting the American economy especially the working and middle class.

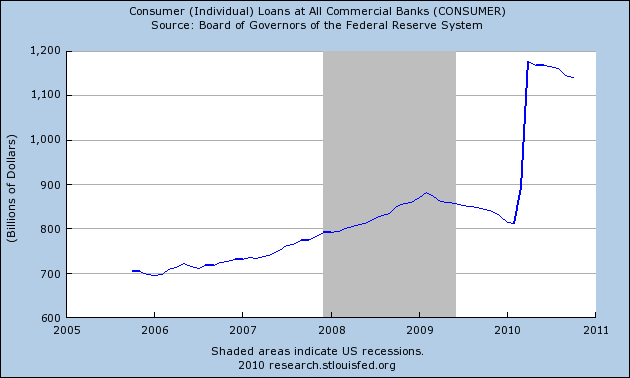

Consumer and individual loans did spike up in 2010 due to easy money and banks being flush with funds. Yet this is now tapering off:

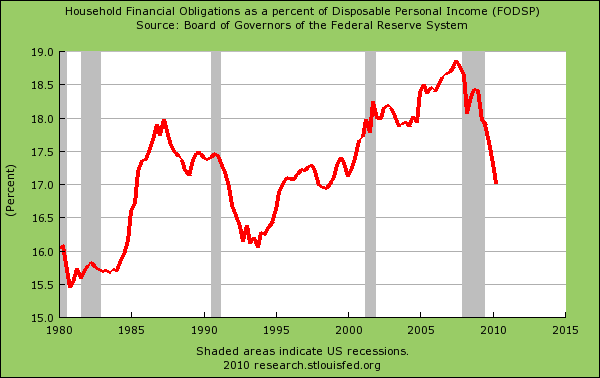

At the same time, is this even something to be happy about? The American consumer is over leveraged so adding more debt doesn't seem to be the solution here. Banks can only make these loans because the Fed is determined to dilute the U.S. dollar and hopefully, in their eyes at least, inflate away current debts including horrific bets on commercial real estate.

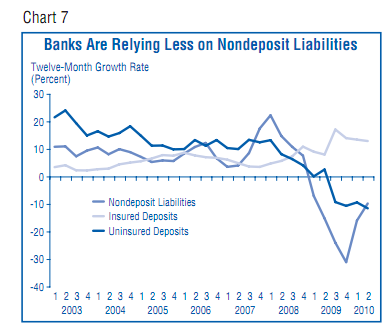

Even in recent years it has become very clear that bankers are relying on more questionable assets to constitute their investment base:

Many observers agree that the current banking system is insolvent and the only thing keeping it afloat is by suspending accounting laws that require mark to market. We have seen this translate into banks moving slowly on bigger priced foreclosures on residential properties but also commercial buildings. The banking system problems of 2007 are still largely present as we end 2010. The only difference now is that they have managed to link up their failure to the U.S. dollar directly. This is why the Federal Reserve is embarking on the quantitative easing path.

Mega banks need to be broken up and a separation between investment and commercial banking is an absolute necessity. It is incredible that no politician (or group of) has taken this up.

"Many Americans are now coming to the stark realization that Washington D.C. and their representatives no longer listen to their voice. They listen to lobbyists and banking interests."

If you recall, the bailouts were largely opposed and the public railed against their constituents. The first vote did not pass the bailout and then politicians used fear and went ahead anyway. This was not the will of the people. Also, it is insulting that nothing was attached to the bailout funds. For example, a stipulation could have been put to break up the banks as a condition of the bailouts. Instead a blank check was given and here we are back with the same system of mega banks and no protection for the people. If our politicians were in a contest for best negotiator they would come in absolute last.

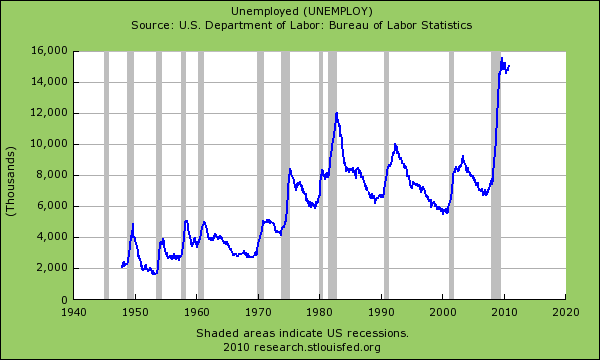

They say this was necessary or the economy would have been even worse. Well let us look at the unemployment rate now versus when the bailouts largely took place:

September 2008: 6.2

November 2010: 9.8

Then we hear the Federal Reserve saying it would have been 25 percent if it weren't for the bailouts. Really? What would it have been if the Fed actually did its job and prevented the housing bubble from taking place to begin with by regulating and enforcing laws against the banks? Do people really trust these guys?

Zillow: Homes fell $1.7 trillion in 2010, same in 2011

This year's estimated decline, more than the $1.05 trillion drop in 2009, brings the loss since the June 2006 home-price peak to $9 trillion, the Seattle-based company [Zillow] said today in a statement.

"It's definitely going to continue into 2011," Stan Humphries, Zillow's chief economist, said in an interview on Bloomberg Television today. "The back half of 2010 looked horrible and 2011 should look like the mirror image of that."

U.S. Home Values to Drop by $1.7 Trillion This Year, Zillow Says

By Hui-yong Yu and John Gittelsohn

December 10, 2010 Bloomberg

Thursday, December 9, 2010

'Prince of Pork' to oversee ban on earmarks

... Um, except it's not. The all-powerful House Appropriations Committee will be chaired by 30-year veteran Rep. Hal Rogers of Kentucky, who brought home $252 million in earmarks between 2008 and 2010.

The Honorable Mr. Rogers will now be in charge of -- don't laugh! -- enforcing the GOP's pledge to ban legislative earmarks, aka "pork" projects.

That's kind of like (choose your poison)...

... the DEA being run by Pablo Escobar

... PETA being run by Michael Vick

... the SEC being run by Bernie Madoff

... the State Dept. being run by Julian Assange

... or the Int'l Atomic Energy Agency being run by Mahmoud Ahmadinejad

But hey, that "hopey changey thing" could always work out for ya teabaggers, yeah?

Hal Rogers, 'Prince Of Pork,' To Be Appointed GOP Chairman Of House Appropriations Committee

December 7, 2010 | AP/Huffington Post

URL: http://www.huffingtonpost.com/2010/12/07/hal-rogers-appropriations-committee_n_793529.html

Tuesday, December 7, 2010

Army Times: 'Ethical' troops fight & die to pay underwater mortgages

But wouldn't it be more supportive to give our troops assistance in meeting their mortgage payments? After all, we bailed out the bankers -- who risk nothing except a papercut at work -- holding their mortgages with more than $9 trillion.

Instead of lecturing our troops about the "ethical" and financial hazards of walking away from their underwater mortgages -- not to mention threatening to revoke their security clearance for unpaid debts! -- why can't Uncle Sam find some cash under Wall Street's couch cushions to help our men & women in uniform?

What indeed our are troops fighting for? Not for a rigged financial system like this, I hope.

Consumer Watch: Walking away from your mortgage

By Karen Jowers

December 6, 2010 Army Times

URL: http://www.armytimes.com/money/financial_advice/offduty-walking-away-from-your-mortgage-120610w/?source=patrick.net

Poll: Afghans want somebody to deliver the goods

"The number of Afghan civilians killed or injured soared 31 percent in the first six months of the year, but they were largely caused by Taliban attacks, according to the United Nations.

"Just 36 percent of those polled expressed confidence in the U.S. and NATO to bring stability, down by 12 percentage points from last year and down by 31 percentage points since 2006. The survey also said 73 percent favor a negotiated settlement with the Taliban, up by 13 percentage points since 2007."

In other words, even though Americans are killing fewer Afghan civilians, and the Taliban are killing more civilians, the Afghan people are more likely to see attacks on the U.S. as justified and want a negotiated settlement with the Taliban. Why? Because the U.S. is not delivering on its promise of peace and stability. Afghans are ready to accept anybody -- including the Taliban -- who can. If America can't deliver then it is just an occupying enemy, reason notoriously xenophobic Afghans.

Our debates in the U.S. about whether to commit to a long-term occupation of Afghanistan will be overtaken by events on the ground: our presence cannot be open-ended if it doesn't lead to significant improvements very soon, because more of the population will turn against us. Their patience is reaching its limit.

Poll: More Afghans See Insurgent Attacks As Justified

December 6, 2010 AP

URL: http://www.npr.org/131845975

Monday, December 6, 2010

Brooks: Today's GOP won't accept 99% success

It sounds like Obama may be wising up to the zero-sum extremists he's up against, but don't hold your breath. He thinks he's transformational, while they say he's a socialist, "and never the twain shall meet," goes the Barack-room balad.

The GOP is going to eat Obama's lunch if he doesn't immediately grow a spine.

David Brooks Slams GOP Obstructionism: 'If You Offered Them 99-1, They'd Say No'

By Alex Seitz-Wald

December 2, 2010 Think Progress

Yesterday, the entire Senate Republican caucus signed a letter vowing to block every piece of legislation unless the body holds a vote on the extension of the Bush tax cuts for the wealthy. This came after two years of a concerted GOP effort to "obstruct, delay, obstruct, delay," as Senate Minority Leader Harry Reid (D-NV) said yesterday. This morning, at a debate with Rep. Paul Ryan (R-WI) at the American Enterprise Institute, conservative New York Times columnist David Brooks slammed the GOP's reflexive obstructionism and demand for ideological purity, saying their "rigidity" harms "governance" and is based on a false world view that progressives are a "bunch of socialists":

BROOKS: And my problem with the Republican Party right now, including Paul, is that if you offered them 80-20, they say no. If you offered them 90-10, they'd say no. If you offered them 99-1 they'd say no. And that's because we've substituted governance for brokerism, for rigidity that Ronald Regan didn't have.

And to me, this rigidity comes from this polarizing world view that they're a bunch of socialists over there. You know, again, I've spent a lot of time with the president. I've spent a lot of time with the people around him. They're liberals! … But they're not idiots. And they're not Europeans, and they don't want to be a European welfare state. … It's American liberalism, and it's not inflexible.

Friday, December 3, 2010

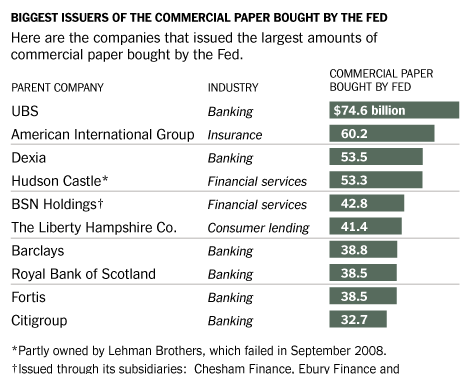

MB360: Fed bailout report reveals 'con of the century'

Posted by mybudget360 December 3, 2010

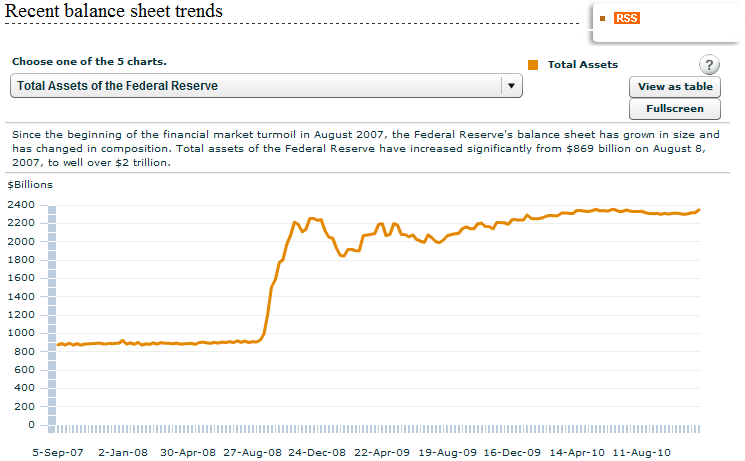

The Federal Reserve released a stunning report showing the details of bailouts that occurred during the peak of the credit crisis. They won't call it "bailouts" but giving money when others won't is exactly that. What the report shows is that the Fed operated as a global pawnshop taking in practically anything the banks had for collateral. What is even more disturbing is that the Federal Reserve did not enact any punitive charges to these borrowers so you had banks like Goldman Sachs utilizing the crisis to siphon off cheap collateral. The Fed is quick to point out that "taxpayers were fully protected" but mention little of the destruction they have caused to the US dollar. This is a hidden cost to Americans and it also didn't help that they were the fuel that set off the biggest global housing bubble ever witnessed by humanity. A total of $9 trillion in short-term loans were made to 18 financial institutions. Still think the banking bailout didn't happen or cost us nothing? Let us first look at the explosion of assets on the Fed balance sheet.

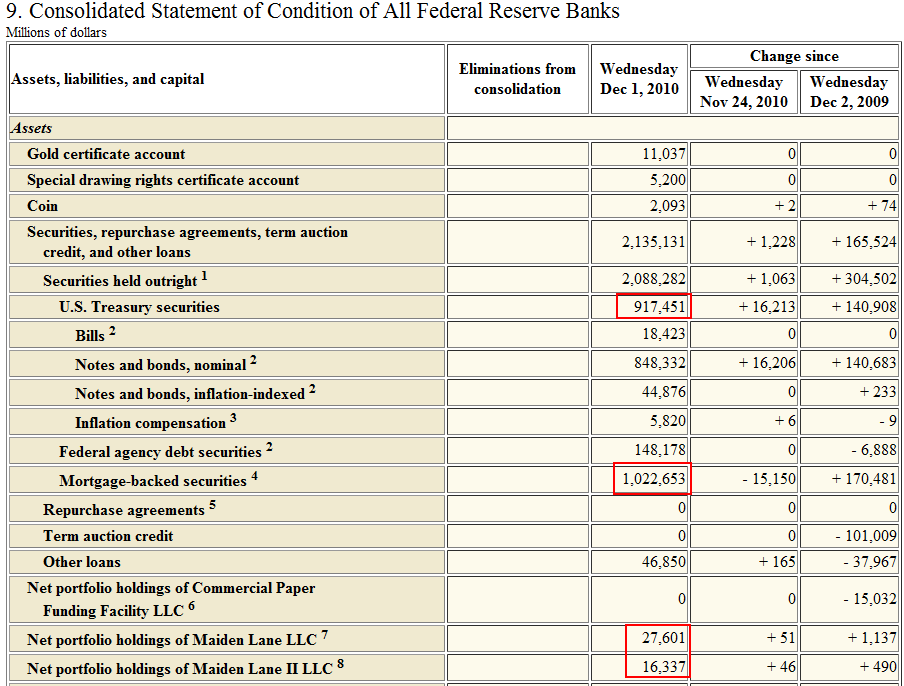

The Fed is still carrying longer term debt on its books that shouldn't be there:

The Fed typically would carry under $900 billion in high quality government Treasuries on its balance sheet. But today it is carrying roughly $2.4 trillion in "assets" and the biggest part of this is made up of questionable mortgages:

Over $1 trillion of mortgage backed securities sit on the Fed balance sheet and QE2 is only starting. Other tens of billions of dollars are sitting in the balance sheet as well that include failed commercial real estate projects and defunct shopping centers around the country. Of course the Fed would like to give the appearance that all is well but no one makes $9 trillion in short-term loans without undergoing serious problems. And doesn't it bother the public that an institution that represents our banking system essentially bailed out the world at the expense of US taxpayers (without asking by the way) and now taxpayers are having to deal with a toxic banking system and a jobs market that is hammered into the ground?

This concern was raised:

"(NY Times) But Senator Bernard Sanders, independent of Vermont, who wrote a provision in the law requiring the disclosures by Dec. 1, reached a different conclusion.

"After years of stonewalling by the Fed, the American people are finally learning the incredible and jaw-dropping details of the Fed's multitrillion-dollar bailout of Wall Street and corporate America," he said. "Perhaps most surprising is the huge sum that went to bail out foreign private banks and corporations."

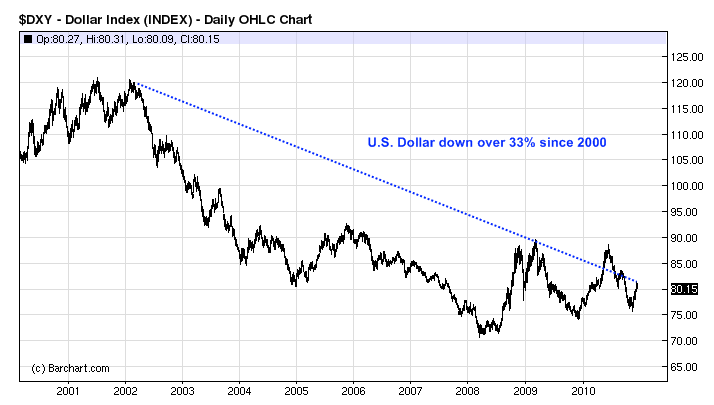

Senator Sanders is absolutely right. Did you also know that billions of dollars went to foreign central banks as well? We all know the issues going on with the European Zone today but the Fed never mentioned this during the bailout frenzy. Don't be fooled when the Fed says there is no cost associated. 26 million Americans are unemployed or underemployed and 44 million Americans are on food assistance. The US dollar has done the following in the last decade:

Yet this is the response:

"In a statement accompanying the disclosure, the Fed said it had fully protected taxpayers. "The Federal Reserve followed sound risk-management practices in administering all of these programs, incurred no credit losses on programs that have been wound down, and expects to incur no credit losses on the few remaining programs," it said."

Sound risk-management? The entire purpose is to destroy the currency in a slow methodical process and inflate away the debt. Yet there is a cost to this born by the many for the few. Over the last decade it has meant the depreciation of the dollar by 33 percent. That is a real cost. It might not be a big deal if you hold money in foreign countries but most Americans only have a paycheck that is issued in US dollars. The actual amount of Fed loans is simply jaw dropping:

"At home, from March 2008 to May 2009, the Fed extended a cumulative total of nearly $9 trillion in short-term loans to 18 financial institutions under a credit program.

Previously, the Fed had only revealed that four financial firms had tapped the special lending program, and did not reveal their identities or the loan amounts.

The data appeared to confirm that Citigroup, Merrill Lynch and Morgan Stanley were under severe strain after the collapse of Lehman Brothers in September 2008. All three tapped the program on more than 100 occasions."

Keep in mind that unemployment insurance will cost roughly $4 billion per month and most of this money will go back into the economy. Congress is stalling on this yet the media is completely silent on the $9 trillion in Federal Reserve loans? This should be the headline story over and over until people realize how big the bailout was (and how this false dichotomy is being used as propaganda in the media as if $4 billion a month is going to bankrupt the system). The banking elites just want to shift the blame to "poor" people while ignoring the elephant in the room which are the trillions of dollars in Fed loans.

Everyone got in the game:

"Big institutional investors, like Pimco, T. Rowe Price and BlackRock, borrowed from the TALF program. So did the California Public Employees Retirement System, the nation's largest public pension fund, and several insurers and university endowments."

Source: New York Times

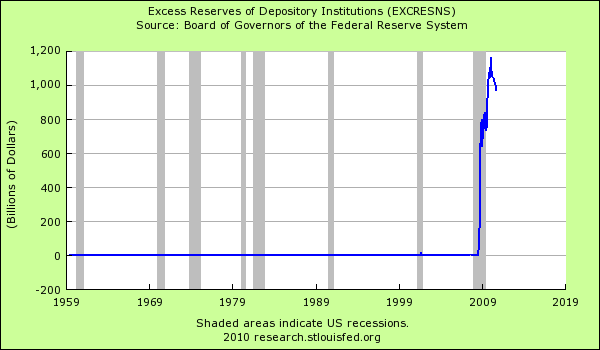

Every big player got into this and you will recall the rhetoric that it was for small businesses and the American consumer. None of that happened. Banks are still sitting on incredibly large excess reserves:

The Fed is operating without any checks and balances from Congress and another trillion dollar exposure has come out with the mainstream media channels like ABC, CBS, and NBC all remaining silent. Can't interrupt Wheel of Fortune right?

Thursday, December 2, 2010

2 out of 3 lib'rul media outlets agree: Obama's a wimp

Obama's Naivete on Bipartisanship Has Finally Caught Up to Him

By Howard Fineman

December 1, 2010 Huffington Post

URL: http://www.huffingtonpost.com/howard-fineman/obamas-naivete-on-biparti_b_790516.html

Liberals: Obama Doesn't Compromise, He Caves

By Ari Shapiro

December 2, 2010 NPR

URL: http://www.npr.org/131733220

GOP Tea Party Caucus pigs out on pork

The anti-pork Tea Party Caucus must have been thinking, "We'll go on a diet AFTER the holidays." No shame in that. Everybody does it, right?

Tea Party Caucus Took $1 BILLION In Earmarks

By Nick Wing

December 2, 2010 Huffington Post

URL: http://www.huffingtonpost.com/2010/12/02/tea-party-caucus-took-1-b_n_790892.html

NKY: Mecca for morons?

(Get this: you can donate a peg for the Ark for $100, a plank for $1,000, or a beam for $5,000. I think a splinter is more my speed....)

Creationist Theme Park Supported By Democratic Kentucky Governor

By Nick Wing

December 1, 2010 | Huffington Post

URL: http://www.huffingtonpost.com/2010/12/01/kentucky-creationist-theme-park_n_790283.html

Post-bailouts, TBTF banks are worse

Personally, I agree with Paul Volcker that the concept of "financial innovation" is baloney. Banking should be boring. In banking, creativity = gambling. And we all know that gambling requires a mark, a sucker, to make it go.

Too Big to Succeed

By Thomas M. Hoenig

December 1, 2010 New York Times

The world has experienced a severe financial crisis and economic recession. The Treasury and the Federal Reserve took actions that saved businesses and jobs and may very well have saved the economy itself from ruin. Still, the public seems ungrateful, expressing anger at these institutions that saved the day. Why?

Americans are angry in part because they sense that the government was as much a cause of the crisis as its cure. They realize that more must be done to address a threat that remains increasingly a part of our economy: financial institutions that are "too big to fail."

During the 1990s, Congress, with encouragement from academics and regulators, repealed the Glass-Steagall Act, the Depression-era law that had barred commercial banks from undertaking the riskier activities of investment banks. Following this action, the regulatory authority significantly reduced capital requirements for the largest investment banks.

Less than a decade after these changes, the investment firm Bear Stearns failed. Bear was the smallest of the "big five" American investment banks. Yet to avoid the damage its failure might cause, billions of dollars in public assistance was provided to support its acquisition by JPMorgan Chase. Soon other large financial institutions were found to also be at risk. These firms were required to accept billions of dollars in capital from the Treasury and were provided hundreds of billions in loans from the Federal Reserve.

In spite of the public assistance required to sustain the industry, little has changed on Wall Street. Two years later, the largest firms are again operating with bonus and compensation schemes that reflect success, not the reality of recent failures. Contrast this with the hundreds of smaller banks and businesses that failed and the millions of people who lost their jobs during the Wall Street-fueled recession.

There is an old saying: lend a business $1,000 and you own it; lend it $1 million and it owns you. This latest crisis confirms that the economic influence of the largest financial institutions is so great that their chief executives cannot manage them, nor can their regulators provide adequate oversight.

Last summer, Congress passed a law to reform our financial system. It offers the promise that in the future there will be no taxpayer-financed bailouts of investors or creditors. However, after this round of bailouts, the five largest financial institutions are 20 percent larger than they were before the crisis. They control $8.6 trillion in financial assets — the equivalent of nearly 60 percent of gross domestic product. Like it or not, these firms remain too big to fail.

How is it possible that post-crisis legislation leaves large financial institutions still in control of our country's economic destiny? One answer is that they have even greater political influence than they had before the crisis. During the past decade, the four largest financial firms spent tens of millions of dollars on lobbying. A member of Congress from the Midwest reluctantly confirmed for me that any candidate who runs for national office must go to New York City, home of the big banks, to raise money.

What can be done to remedy the situation? After the Great Depression and the passage of Glass-Steagall, the largest banks had to spin off certain risky activities, and this created smaller, safer banks. Taking similar actions today to reduce the scope and size of banks, combined with legislatively mandated debt-to-equity requirements, would restore the integrity of the financial system and enhance equity of access to credit for consumers and businesses. Studies show that most operational efficiencies are captured when financial firms are substantially smaller than the largest ones are today.

These firms reached their present size through the subsidies they received because they were too big to fail. Therefore, diminishing their size and scope, thereby reducing or removing this subsidy and the competitive advantage it provides, would restore competitive balance to our economic system.

To do this will require real political will. Those who control the largest banks will argue that such action would undermine financial firms' ability to compete globally.

I am not persuaded by this argument. History suggests that financial strength follows economic strength. A competitive, accountable and successful domestic economic system, supported by many innovative financial firms, would restore the United States' economic strength.

More financial firms — with none too big to fail — would mean less concentrated financial power, less concentrated risk and better access and service for American businesses and the public. Even if they were substantially smaller, the largest firms could continue to meet any global financial demand either directly or through syndication.

Crises will always be a part of our capitalist system. But an absence of accountability and blatant inequities in treatment are why Americans remain angry. Without accountability, we cannot hope to build a national consensus around the sacrifices needed to eliminate our fiscal deficits and rebuild our economy.

Thomas M. Hoenig is the president of the Federal Reserve Bank of Kansas City.

Wednesday, December 1, 2010

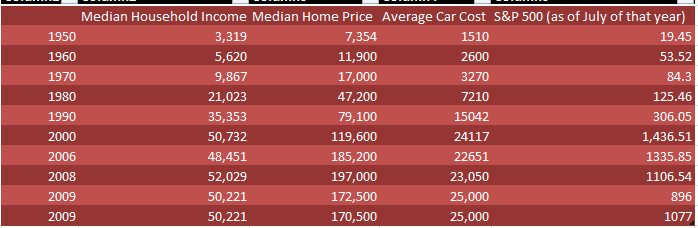

MB360: 2.2 housing:income ratio wrecked since 2000

Posted by mybudget360

November 30, 2010

The typical American family is facing the biggest economic uncertainty since the Great Depression and must feel like their lives are in a washer spin cycle. Many unemployed Americans are now entering a stage where unemployment insurance is being cut off which will send tens of thousands of people into the street. The mainstream media won't cover this because they rather gossip about the next tan face to drink themselves into a gutter at a nightclub. 43 million Americans are receiving some kind of food assistance yet this is some kind of recovery? Many are wondering how banks can produce such large profits without actually producing anything real or of substance in the economy. Yet banks are largely casinos that now operate to siphon off real wealth from the economy through bailouts, frauds, and other activities that harm the overall economy. In a decade where banks were unleashed to do what they may with limited regulation and a cozy Fed, we are now left with an economy in tatters but a banking sector that is still healthy based on oversized bonuses. I wanted to gather data over the last 60 years and measure how most Americans are now fairing. The data shows a largely underwater nation.

Let us look at the data carefully:

Back in 1950 the median home price cost a little above 2 times the annual median household income:

1950: $7354 / $3,319 =2.2

In 1960 the ratio remained roughly the same:

1960: $11,900 / $5,620 = 2.1

In fact, over this ten year period the typical household gained buying power when it came to housing. Even in 1970 the ratio became more favorable to US households:

1970: $17,000 / $9,867 =1.7

This was the lowest point at the start of any decade in modern history. After this point, with all the push for deregulation and allowing Wall Street to run rampant prices remained fairly stable only because of the two income household (that is until we hit 2000):

1980: $47,200 / $21,023 = 2.2

1990: $79,100 / $35,353 = 2.2

2000: $119,600 / $50,732 = 2.3

This was sustained via the two income household:

After this point, things went haywire. Incomes went stagnant or dropped yet home prices sky rocketed. Even today after the severe correction the ratio is still out of sync with 50 years of data:

2010: $170,500 / $50,221 = 3.3

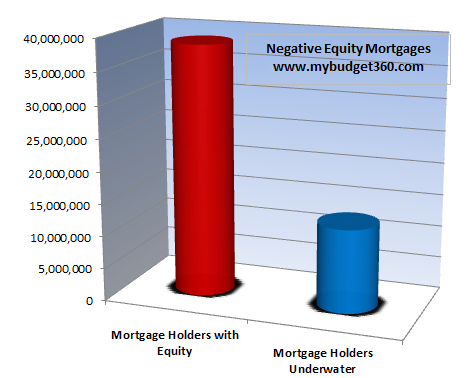

In fact, given the current income levels the median nationwide home price should be down to $119,000 (a 30% drop from current levels). Some will argue that we should factor in for inflation. This would only be the case if we also saw wage growth. For the first time in modern history did we see wages stagnant for an entire decade. So the average American family is still looking at inflated assets and that is why we have millions of people sitting in underwater homes:Just think of what negative equity represents. It represents a household that has over paid for a home. I don't think the desire to own a home has dramatically gone up or down in the last fifty years. Homeownership has always been a big part of the American Dream. But what happened over the last ten years is that banks were able to get their grubby hands on mortgages and convert them into another commodity where they could place large bets and ultimately push losses to taxpayers. People that over paid are paying via foreclosure. What is the penalty that banks are paying? That is why now that banks have raided and had their way with housing, they are looking for other markets to gamble in (with taxpayer money). The above chart shows the millions of homeowners who hold mortgages that are worth more than the homes they are in. Any thinking person realizes that the only way home prices are justified at current levels would be if incomes shot up to make the ratio closer to 2.2. Over half a century of data and never did we have a housing bubble on a nationwide level. All of a sudden Glass-Steagall is repealed in 1999 and a housing bubble takes off with banks leading the way because the line between investment and commercial banking was blurred. Only those who want to deceive themselves would place blame elsewhere.

The average American is going to struggle throughout the next decade. It is hard to see how wages will go up so it is likely that home prices will adjust lower given the magnitude of foreclosures in the pipeline. People might be jumping up and down about the recent job growth but they are occurring in lower paying sectors. So this does nothing to justify current prices. Low mortgage rates are merely a gimmick so banks can use cheap money to speculate on a global scale. Even with mortgage rates at levels we've never seen the housing market remains stalled like an old car. Why? Because the actual sticker price is still inflated based on income levels.

We need to reform the banking system, break up investment and commercial banks, and finally restore sanity in the market. There is a reason the metrics are all off but nothing has been done to change this so we are only a short ways away from another crisis. Ireland for example can be likened to a homeowner that took on too much debt with too little income. So the international banking sector idea of a solution is to extend them a credit line? What they should do is tell the IMF and Euro to shove it, default, and start from scratch and learn from their mistake. Otherwise, they'll be in the same position as Americans who bailed out their corrupt banking sector.

GOP playing political games with our lives

"Despite what some Democrats in Congress have suggested, voters did not signal they wanted more cooperation on the Democrats' big-government policies that most Americans oppose," McConnell and incoming House Speaker John Boehner, R-Ohio, wrote in an op-ed article published in the Washington Post.

Yeah, big-spending Democratic policies like reducing Russia's nuclear weapons stockpile -- the biggest existential threat to America's security.

That's right, they're playing with U.S. national security just so they can deny any more legislative wins for the Democrat-controlled 111th Congress, even though Republicans in the Senate have vetted the START treaty for months, and Dick Lugar, the GOP's foremost foreign policy expert, supports it. Typical.

GOP Plans to Block Democratic Bills in Senate

December 1, 2010 AP

URL: http://www.foxnews.com/politics/2010/11/30/senate-republicans-plan-block-nearly-bills/

SCOTUS scores one for sanity

Monday was a bad day for nutjobs, when the Dubya-stacked conservative Supreme Court refused to hear another one of their crazy birther lawsuits.

Even worse for nutjobs was CNN's Anderson Cooper taking chief birther and Texas state representative Leo Berman out to the woodshed on live TV.

I stand in awe of the total lack of shame of birthers like Berman who claim they "don't know anything about Obama," and at the same time claim to "know" about his real, secret radical agenda, hatred of the U.S., love of socialism, etc. If we don't know anything about him, then he really could be the Messiah -- or a Martian, or the Tooth Fairy. Who knows? Because we don't know anything about Obama. He's a total mystery.

Justices turn aside another challenge over Obama's citizenship

By Bill Mears

November 30, 2010 CNN

URL: http://edition.cnn.com/2010/POLITICS/11/29/scotus.birther.appeal/index.html