Posted by mybudget360

The shrinking of the American middle class is painful to watch. Shopping at the grocery store I've noticed more and more people with unique debit cards that don't look like your typical debit or credit card. These are actually the modern day food stamps and help to take away the stigma of pulling out a pile of paper coupons. My anecdotal observations are confirmed by the data.

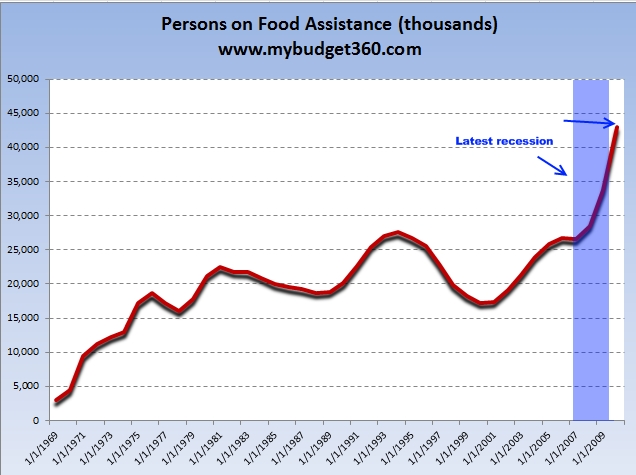

Since September of 2009 we have added a stunning 6,000,000 Americans to the nationwide food assistance program. In fact, even as some are touting how great things are in the last month we added 521,000 more Americans to the food assistance program. Let me reiterate, we added half a million Americans to the food assistance program in the latest month of data. Is this really what we have in mind as a recovery? The latest data shows 43,000,000 Americans now receive food assistance. When we chart this data out it is rather startling.

You will notice that from 2000 onward the growth in food assistance participation has shot directly up:

Source: SNAP

To put this in context, 13.8 percent of all Americans (1 out of 7) are now on some sort of food assistance. If we go back to the deep recession of the 1980s the rate was slightly above 10 percent. We are in all-time record territory here and the numbers just keep on expanding. What is more troubling is many more Americans that were once in the middle class are being thrown out of their homes, losing their jobs, and finding themselves in the unfortunate spot of needing to seek food assistance. An almost seamless transition from the American Dream to being one paycheck away from living in a car. It isn't for want of working. Delta Airlines recently was hiring 1,000 flight attendants and had over 100,000 people apply:

"(ABC) All this for a job where passengers are often rude, hours can be unpredictable and the starting salary is in the upper $20,000s. But flight attendants say they wouldn't trade it in for any other job. (Delta's flight attendants recently voted down a push to unionize.)"

As we've noted before, the chasm between the very rich and the poor has never been this big. We would have to go back to the Great Depression to find similar income inequality.

72,000,000 wage earning Americans make between $0 and $25,000 per year. The top 72 wage earners in the US in 2009 made an average of $84 million. The stock market has certainly recovered but how much of an impact has this had on improving the economic prospects of typical Americans? What we are seeing is a rather common attribute of many Latin American countries. A stunningly wealthy upper crust of society and the large working poor majority. The middle class is virtually non-existent. Clearly we are nowhere near that given we are still the number one global economy. Yet we have now put the car in reverse and the above chart of food stamp participation shows you where we are heading if we do not change course.

We can even see this split in purchasing behavior this holiday season:

"(WaPo) This holiday season, those two worlds have been thrown into stark relief: At Tiffany's, executives report that sales of their most expensive merchandise have grown by double digits. At Wal-Mart, executives point to shoppers flooding the stores at midnight every two weeks to buy baby formula the minute their unemployment checks hit their accounts. Neiman Marcus brought back $1.5 million fantasy gifts in its annual Christmas Wish Book. Family Dollar is making more room on its shelves for staples like groceries, the one category its customers reliably shop."

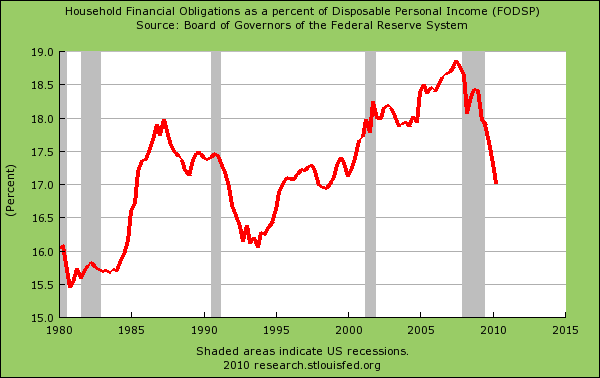

So you have the top of the top doing well once again and we have seen this with a resurgence of banking profits thanks to the generous taxpayer bailouts. At the lower end, organizations like Family Dollar are doing well in a market that is finding many new customers. Customers that may have once shopped at say a Target are going to lower priced places either out of necessity or out of a new sense of austerity. In fact, we have seen the debt burden Americans carry decrease because of bankruptcies, foreclosures, and simply paying down debts:

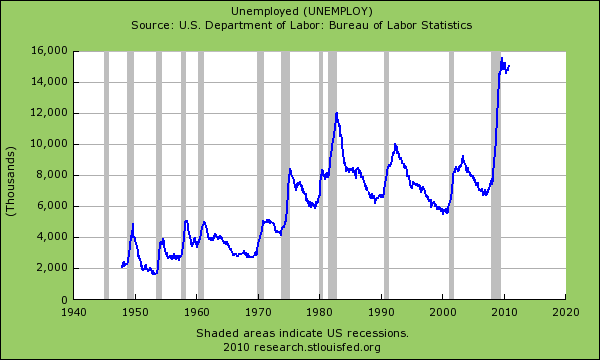

The above would be better news if the major decrease was due to paying down already accumulated debts. Yet the problem of course is much of this is happening via debts being written off (i.e., foreclosures). But you have to ask what is happening at a deeper level here. The once standard of the American Dream, owning a home is now being retracted and the blanket is being pulled slowly back. Many Americans cannot afford to own a home because of an employment market that has been sold off to the global market over the past few decades. Some of it is inevitable but a lot isn't. It is naïve to think that there was truly a need to bailout the banking industry instead of actual employment sectors that can give jobs to the 15 million unemployed Americans or the other 9 million who are working part-time but want full-time work. It was also a giant banking pretense regarding toxic mortgages because Wall Street knew full well of the junk they were selling but wanted to milk the game as long as possible and once it blew up, it would hand over the hot potato to taxpayers.

The employment situation for households making less than $50,000 (aka half the population) is still deep in a recession:

"Economists say the biggest obstacle to a robust recovery is the high unemployment rate, which has hit workers with little education and low household income the hardest. The jobless rate for workers without a high school diploma is 15.7 percent – well above the national average and triple the rate for college graduates, according to government data. Meanwhile, the unemployment rate among households that had been making less than $50,000 is 15 percent, well above the national average of 9.8 percent, according to consulting firm Bain & Co."

And this is reflected in the unemployment charts:

Where is the recovery? It isn't happening for working and middle class Americans. The bailouts in fact where a methodical mechanism that shifted resources and money from the vast majority to the few at the top. Many extremely wealthy organizations have earned their keep by fair competition. Yet the banking sector has created the biggest moral hazard in this country with outrageous profits and bonuses that only exist because of the cronyism between Wall Street and D.C. The fact that we are adding hundreds of thousands of Americans to the food assistance program on a monthly basis shows us the disappearing middle class. That is why you don't hear any economists or "analysts" on CNBC talking about the booming middle class. You don't hear about it because it isn't happening. In fact, they are too busy to look at how many of their fellow Americans are paying for daily necessities.

No comments:

Post a Comment