The top One Percent of Americans are those who earn $1 million or more in gross adjusted income per year.

Meanwhile the median annual income per American worker is $26,250.

And 75 percent of total income tax is being paid by households earning $500,000 or less per year.

These stats put things in perspective, don't they? Looks like OWS is right on the mark.

Posted by mybudget360 | October 26, 2011

This weekend I spent time digging through IRS and Social Security data to get a better perspective on working and middle class Americans. I find it amazing that in a consumer driven economy, meaning we live to spend in some respect that the media never even bothers to focus on household incomes. Even on self branded "business" programs with fancy watermarks which tout their major expertise on knowing about Americans they fail to do any analysis on income. Need we even point out their missing of the biggest economic recession in our recent history? This silence as you know is purposeful. The media is largely beholden to advertisers and it might be perceived as a downer to tell the public how far back they have gone in the last decade on the income treadmill. It is understandable although not acceptable that large television outlets do not discuss wages and income but what about the respectable press? Where is there voice? Either way, as we dig into the data it is understandable why so few even bother to cover this unsavory topic.

Tax return data by income levels

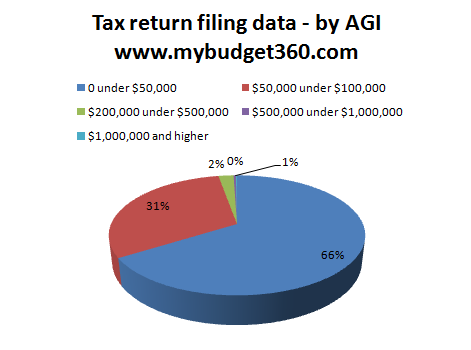

First, let us gather a glimpse of actual household tax filing information:

Source: IRS

With all the discussion about the 99 percent I think you have many people that are largely off on what they assume is the one percent. The media is largely to blame and I have even seen business outlets interview people that claim to make $100,000 and are afraid of being taxed because they are in the one percent. Uh, not exactly.

Let us examine the data:

66 percent of tax returns show an adjusted gross income of $50,000 or less31 percent of tax returns show an adjusted gross income between $50,000 and $100,000

So with these two groups, you are covering 97 percent of all households. Now keep in mind we are looking at adjusted gross income so actual wages will be higher, but not by much.

"So what does it take to be in the top one percent? You will need an adjusted gross income of $1,000,000 or more."

Even folks with an AGI between $200,000 and $500,000 don't fall in this category. Of course Wall Street investment bankers want to make people believe that even with a $100,000 household income that somehow if investment banks were regulated that they will lose their entire life savings (this is actually already happening with housing and the casino known as Wall Street).

Let us dig deeper into the tax data.

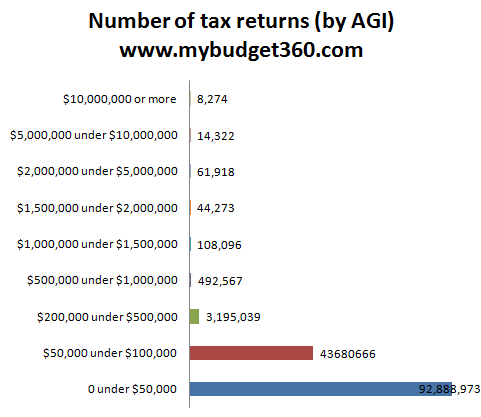

Tax returns broken down further

Out of roughly 140 million tax returns in the latest data, 92 million had AGI of less than $50,000. Couple this with Social Security data which is based on raw W2 income and we find that the typical American worker is pulling in $26,000 a year. Is this giving you a better perspective of wages in the United States?

It isn't the case that those at the very top are increasing in number in a sizeable level, it is that the few at the top are getting wealthier and wealthier because of a:

-1. System favoring lobbying even if it is negative for the overall economy (which it is)

-2. A system where Wall Street speculators pay less on their taxes than regular households

-3. A government for the banks and run by the banks

-4. A financial system focused on short term profits instead of long term sustainability

-5. A system that bails out the wealthy and forces the losses on the public

This is unfortunately the way the system is tilted at the moment. You have high frequency trading that is all about making a quick buck on mini trends. What about charging a surcharge on every transaction? Let the hedge funds go wild but they will need to pay for it. The poor buy and hold investor stands no chances against these Wall Street gamblers.

The burden of student loan debt

Hopefully this gives you a better perspective on the tax side of the equation. Contrary to how some big business shows portray the working class, 75 percent of total income tax is being paid by households making $500,000 or less. Of course the perception is that millionaire households are carrying the largest burden here which is not true.

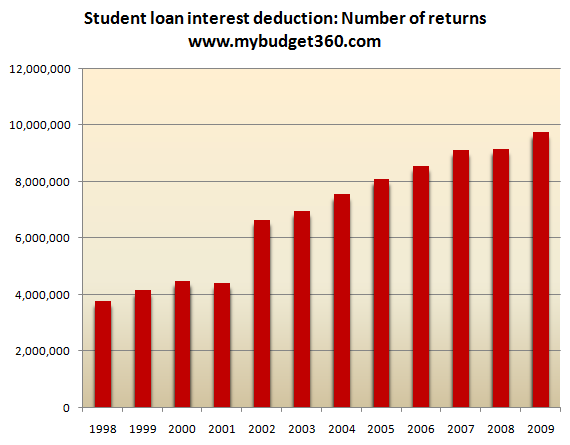

It is hard to get data on how many people are carrying student loan debt. I think I may have accidentally stumbled on a great measure for this. Since you can deduct student loan interest why not see how many people are claiming this on their tax returns?

Source: IRS

Now the above may understate the number of students in debt because it looks like one tax return may have two people claiming the deduction but only showing up as one (for one tax return). This is stunning data. In 2000 roughly 4,000,000 were claiming the student loan deduction. By 2009 this number was nearly 10,000,000! I'm sure once we get IRS data for 2010 we will see this figure surpass 10,000,000. This just highlights the fact that with rising education costs and declining household incomes, more and more Americans are simply financing their education. Why else would those claiming the student loan deduction surge nearly 150 percent in a decade?

The disappearing middle class

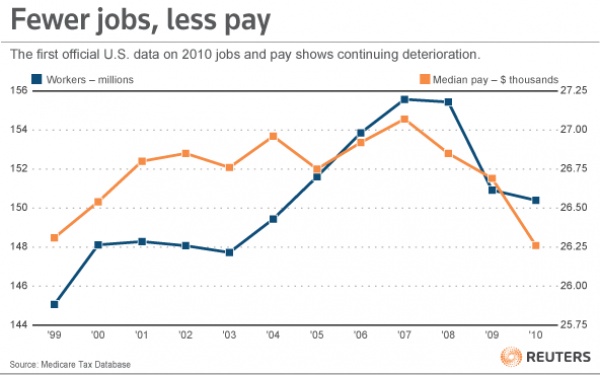

Another troubling data point was found in the Social Security data showing an entire decade of wiped out wage growth:

Source: Social Security, Reuters

Since the recession hit in 2007 actual pay has been decimated. The median per worker wage for Americans fell from roughly $27,000 in 2007 to $26,250 in 2010. This is in nominal terms so inflation is eating away even more and more at the middle class as the Federal Reserve continues to bail out the banking sector.

It is rather clear why the press doesn't want to cover this. They want to keep people spending and believing in the financial system even though it is completely rigged. Why bring this up? Yet as we reach peak debt situations around the world we have tough decisions to make.

No comments:

Post a Comment