By mybudget360 February 10, 2011

The American banking system has transformed the economy into one enormous speculative casino with bells and whistles and free cocktails for those that participate. The problem of course is that most don't have excess income to drop into the financial slot machines. Now banking in better times should be seen as the lubricant of the economy. It allocates capital to areas in the economy where actual real growth was occurring. Today the financial sector operates as an incestuous industry funding growth in its own industry. A snake swallowing its own tail but when the inevitable end comes, it is society that is forced to pick up the tab. Ultimately profits have to come from something real and not just skimming imaginary profits from interest. This banking welfare is largely a reason why our economy is faltering on the vine and Wall Street banking profits are soaring. It is no coincidence that as debt pilfered the economy that financial profits soared. We are living in era that can be dubbed the financialization of the American economy.Debt leverage and banking profits go hand in hand

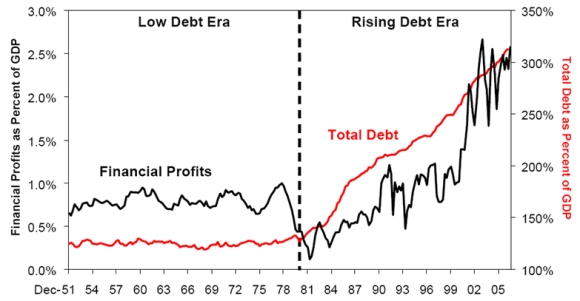

Source: Peak Watch

The above chart really highlights the destruction of our economy in a rising debt era. In a low debt era financial profits were held in check from the 1950s to the early 1980s. Financial profits as a share of GDP hovered around one percent. That all changed in the 1980s and finally reached an apex in our Great Recession. The financial sector grew its profit margins at a time where more Americans were borrowing and going into debt to finance a lifestyle that was setup for a solid middle class. Yet the middle class was not there and many used debt to play a game of pretend for a few decades. All this was playing out during a time when the top 1 percent that were heavily vested in the banking sector were usurping wealth from the real economy.

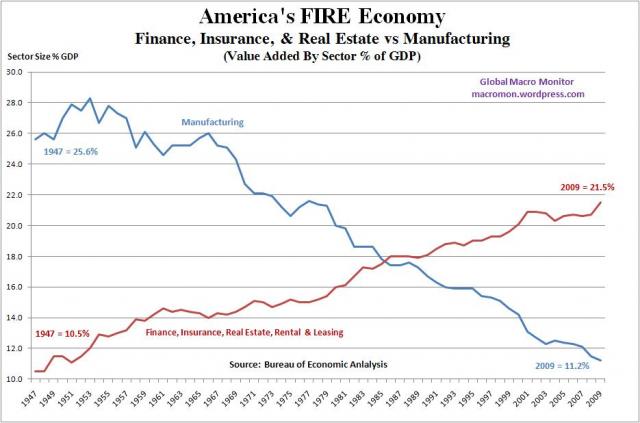

It is no coincidence that during this time our workforce has shifted from manufacturing to finance:

Source: Macromon

We have done a complete 180 turn here. In 1947 the manufacturing sector contributed 25.6 percent to our entire GDP base while the FIRE sector made up 10.5 percent. In 2009 FIRE makes up 21.5 percent while manufacturing is down to 11.2 percent. Given the massive fraud, corruption, scandalous rent seeking behavior, and graft why should we be happy with all the bailouts given to this sector? The financial industry has largely become one giant casino and the stock market no longer reflects the health of the US economy. Most banking profits are now being made overseas as this nation's bailouts are going to global banks that are now fueling the growth and speculation abroad. This is what Americans get in exchange for trillions of dollars of bailouts to what are largely legalized loan sharks.

To further highlight how the financialization of America has harmed the economy we need only look at the stagnant wages of American families. 2000 to 2010 was the first decade where the median household income fell since the Great Depression era of the 1930s. This all happened during a time of unrestrained financial speculation and growth. What happened in the 1920s? Rampant financial fraud by banks so it is no surprise that we ended up in the same place. The only difference today is that after the crash nothing has changed. We still have the same financial sector in full operation. Half of American workers make $25,000 a year or less. This is such an important point because it demonstrates how the quality of life for many has gone negative in the last ten years. On this path the financialization of the country will continue to throw more off the middle class pedestal (or at least what remains of it).

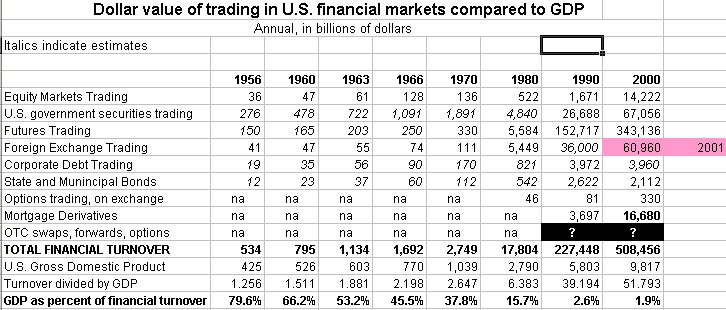

To further demonstrate the casino like nature of our stock markets just look at the actual trading volume for various markets over the last 60 years:

Source: BIS, Wikipedia

This is a fascinating look at how much stock markets have become like casinos.

"In 1956 for example total dollar volume traded on various markets amounted to $534 billion. At the same time US GDP was $425 billion. Most of the trading occurred in boring and safe government securities. Fast forward to 2000. $508 trillion is traded and US GDP is only $9.8 trillion!"

What is even more insane is the amount being traded on the foreign exchange markets. $343 trillion was traded when global GDP is roughly $54 trillion. How can this be? The global stock markets are largely vacuums sucking the life and productivity from working class people all over the place. Investment banks make their profits as rent seekers and leech onto productive sectors of the economy that actually make things.

The financialization of our country has led us to a situation where bailouts are handed out to investment banks without any oversight because so much wealth is aggregated in these few hands. These industries have bought out our government and have laws and regulations that are stripped down to the point where all the above is allowed. Maximum leverage and if things go bust the taxpayer will be forced by their bought out politicians to bailout these sectors. Since the debt needs to be repaid, many in their local communities are witnessing rising taxes and cuts to local services. This happens under the guise that people need to tighten up their belt. Of course this happens at a time when global trading markets are leveraging their volume tenfold the amount of global GDP. Don't be fooled, the real culprits here are the banks and the financial sector. There is graft in many areas of the economy but this is the nucleus of the mess. If things keep going forward in this financialization phase there will be no middle class in the US in 10 to 20 years.

No comments:

Post a Comment