Posted by mybudget360

May 18, 2013

Many Americans view a college education as a way to build a better life. College is seen as an avenue for better prosperity and the ability to pull yourself up beyond your current circumstances. In fact, after World War II programs like the G.I. Bill allowed many Americans the opportunity to pursue a college degree. In many cases, the United States at this time developed the largest middle class the world had come to know. This is still the case today but the economic trends show a shrinking middle class that is largely having a tough time competing in this quickly globalizing economy. One fact that stands out is that back in 2004, student debt was the smallest portion of all non-housing related debt in the US. Only a short nine years later, student debt is the largest portion of debt in non-housing related debt. What happened in this short period of time and what information can we pull from the mountains of student debt information?

Student debt and the decade of massive growth

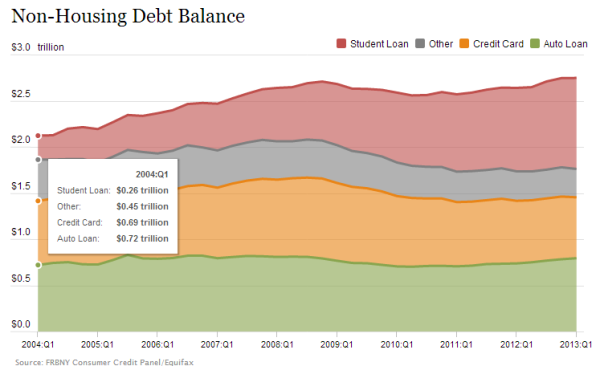

One could argue that every segment of the economy experienced a growth in debt over the last decade. That is not true. Let us examine non-housing related debt carefully:

Source: Federal Reserve, Equifax

This is an interesting chart. What we find is that Auto debt was the largest debt segment in 2004. This was followed up by credit card debt and then other debt. Student loan debt at this time was $260 billion. In total, student debt made up 12 percent of all non-housing related debt back in 2004.

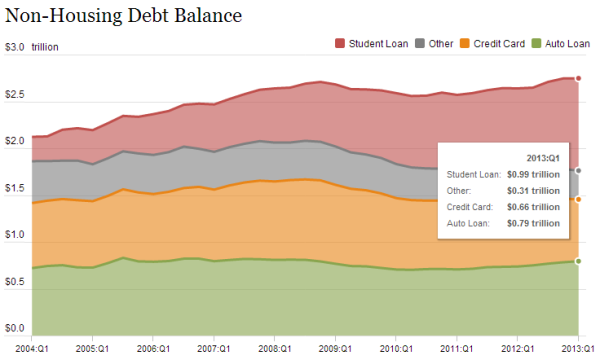

Fast forward to where we stand today:

Source: Federal Reserve, Equifax

Student debt is now by far the largest portion of non-housing related debt in our economy. Student debt is now well above $1 trillion. The growth of student debt in this short window was 284 percent. Student debt now makes up a stunning 36 percent of all non-housing related debt. What is interesting then is when we compare this to the growth of the other segments of non-housing related debt:

Growth between 2004 and 2013

Non-housing related debt

Auto loans: 9%

Other: -31%

Credit Card: 4.5%

Student Debt: 284%

In essence, nearly all the growth in non-housing related debt over this time has come from student debt growth. This makes the following data more troubling regarding the amounts of student debt by tiers but also the rising number of delinquencies:

“(NY Times) According to the Federal Reserve Bank of New York, almost 13 percent of student-loan borrowers of all ages owe more than $50,000, and nearly 4 percent owe more than $100,000. These debts are beyond students’ ability to repay, (especially in our nearly jobless recovery); this is demonstrated by the fact that delinquency and default rates are soaring. Some 17 percent of student-loan borrowers were 90 days or more behind in payments at the end of 2012. When only those in repayment were counted — in other words, not including borrowers who were in loan deferment or forbearance — more than 30 percent were 90 days or more behind. For federal loans taken out in the 2009 fiscal year, three-year default rates exceeded 13 percent.America is distinctive among advanced industrialized countries in the burden it places on students and their parents for financing higher education. America is also exceptional among comparable countries for the high cost of a college degree, including at public universities. Average tuition, and room and board, at four-year colleges is just short of $22,000 a year, up from under $9,000 (adjusted for inflation) in 1980-81.”

Averages do hide a lot of the facts but what we can deduct is that the 13 percent that owe more than $50,000 and the 4 percent that owe more than $100,000 have largely come in the recent decade. While the cost of tuition has soared in this short period of time a large part of it has not corresponded to actual earnings:

What is interesting about the above chart is that real tuition is up (with new data) by close to 70 percent while real earnings are roughly the same as they were back in 1991. So over a 20 year period college costs have soared but the return doesn’t seem to justify the rise. We also have the proliferation of non-profit schools that target lower income Americans and provide them a questionable level of education. Yet this is only one small part of the larger issue. The addiction to debt. We have discussed how this recession has hit young Americans incredibly hard. In the current marketplace it has become hyper-competitive and expensive while starting salaries have fallen behind when it comes to inflation. The rising number of delinquencies also shows that many students are simply unable to pay their debts.

If student debt were to grow at the current rate, we would be at $3.84 trillion in student by 2023. Do you think that is sustainable? If not, something has to give.

No comments:

Post a Comment