Student loans, however, are not like this, for the simple reason that they are non-dischargeable in bankruptcy. They are not a bubble and cannot become one. What they can become -- and show increasing signs of actually becoming -- is an anchor that is sinking the fortunes of an entire generation.

But just because they're not a bubble doesn't mean these levels of indebtedness are not extremely worrying. They are. These delinquency rates mean that graduates are not getting the kinds of jobs they thought they would get thanks to their expensive degrees. If higher education is not the key to employment and higher income, then what is? So far, our nation does not have another answer.

By mybudget360

June 30, 2013

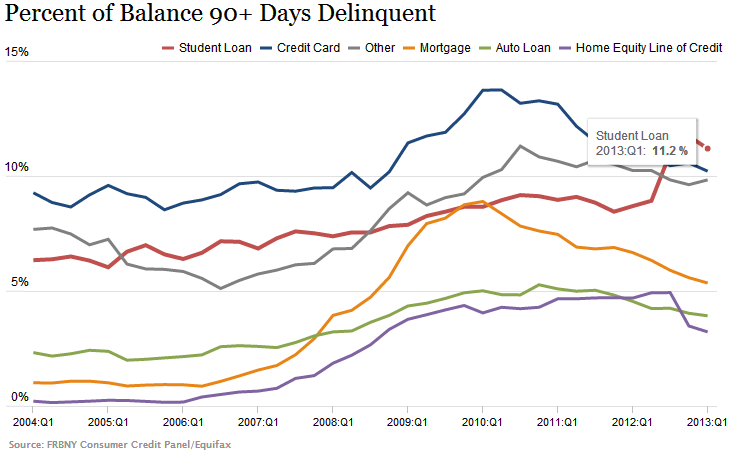

If the news for college graduates couldn’t get any better. Our woefully motivated millionaire Congress is unable to figure out what is necessary to stop the doubling of interest rates on student debt. While the Fed can turn on a dime to rectify zero percent interest rates for member banks, trying to help the youth of the nation well, that is just too hard to do. Milling around through the data I found that for the first time in history, student debt had the highest delinquency rate of all household debts. This is a big deal given that Americans now carry over $1 trillion in student debt and most of it is in the hands of the young. At the nucleus of this argument is that people are going into too much debt to finance their educational pursuits. Collecting tips at the Olive Garden is not exactly going to payoff that $50,000 in student debt. How is it that the Fed can subsidize big banks with zero percent rates so they can speculate in real estate and other ventures while college graduates are now faced with the doubling of interest rates?

Half of college graduates not utilizing degree

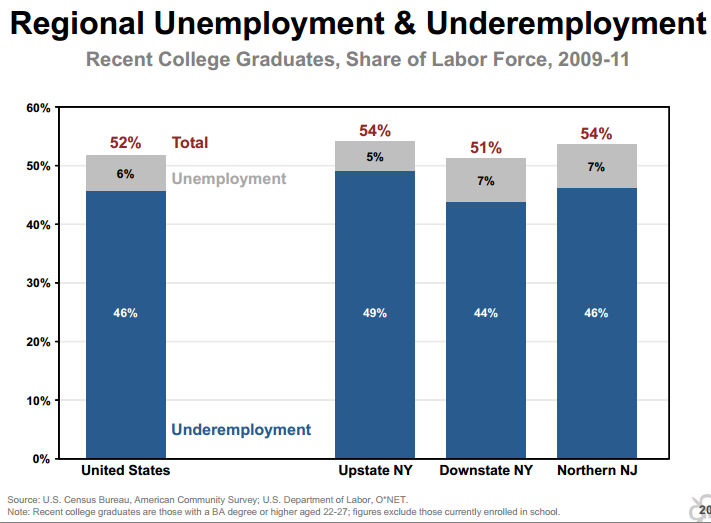

Part of the problem is the voting power (or lack of it) from younger Americans. Many simply do not vote. And the baby boomer cohort is guiding many policies through elected officials although they only serve a tiny pizza slice of the baby boomers at that. So with that said, the voice of the young is largely drowned out by big business and higher education has turned into a very lucrative private-public venture. With that as our backdrop, half of college graduates are not utilizing their increasingly more expensive degrees:

Half of recent college graduates are either unemployed or underemployed. And recently many have given up on pursuing careers where their degrees would be utilized and have taken up other jobs. Other jobs that would have gone to lower skilled workers. And of course, these workers get pushed down into a lower level of the economic ladder. And what a shocker that as we go into the various levels of Dante’s Economic Inferno we find that 47.7 million Americans are on food stamps.

The above chart is rather sobering because many recent graduates are leaving school with high levels of debt. Incomes for many of these graduates are not justifying the sky high rates of tuition at many schools. Education is still a worthy venture and that is why people continue to go into high levels of debt for this. Yet our banking system has been rather obsessed with one sector of our economy since the tech bubble burst in the early 2000s. Real estate has seemed to dominate every big decision in the last decade to the detriment of creating an economy where millions of jobs are added to meet this more educated workforce. That has clearly not happened. Colleges are not going to turn their back on willing students with fresh loans in hand. And I suppose that is the point. Easy access to debt is like an aphrodisiac for the industry. Go to any college campus and you will see palatial stadiums and massive buildings. Do Olympic sized pools make people discover cures for modern diseases quicker?

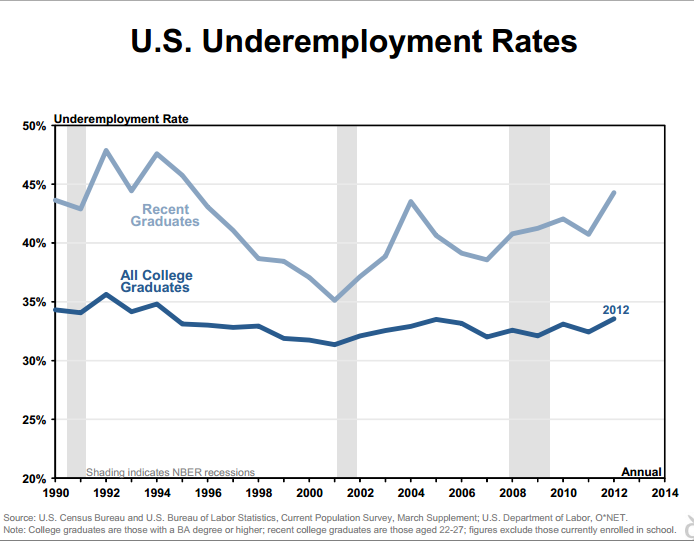

What is even more troubling is that the underemployment rate for recent college graduates has trended up in the last few years while the overall unemployment rate has fallen:

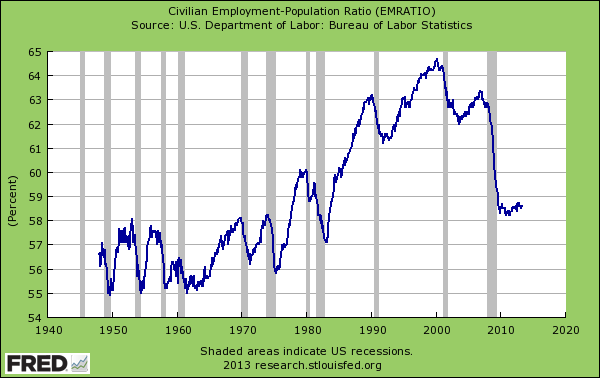

No, we are not looking at a chart of Spain or Greece but a chart of US recent graduates. A large part of the decline in the unemployment rate has come because the civilian employment population ratio continues to lower:

While many older Americans have dropped off the radar, many recent graduates simply do not have this option. Many over the last few years have clearly opted to take on jobs that are underutilizing their degrees. Does that mean they overpaid for their education? $1 trillion in student debt seems to give us an answer that not only did many overpay, they didn’t even have the funds to afford it in the first place. Higher tuition would make more sense if wages were also rising but that doesn’t seem to be the case with the new batch of graduates. And many are falling into student debt quicksand and are unable to pay the loans they now have.

The most delinquent of them all

Student debt before the 2000s hit was typically a safe financial bet. Delinquencies on student debt reflected this. Today, we now find ourselves at the precipice of another bubble with student debt having the highest delinquency of any form of household debt:

You can see this rate doubling only in the last few years. Keep in mind this is occurring without the potential doubling of student loan interest rates. Rates are set to go from 3.4 percent to 6.8 percent if Congress does not act. Amazingly, they are able to act quickly when it comes to the interest of large banking but to help the young in our nation? No, let us go on holiday break and see what happens.

The rising delinquency rates are simply the last straw in the student debt bubble. This is a bubble. When you have prices soaring without any underlying economic change, you have a big problem on hand. Keep in mind that what you can afford and the price of something are fully disengaged since the government will lend pretty much whatever is necessary to go to school. If the cap was $100,000 a year, you can rest assured you will have some for-profits cropping up with $100,000 a year degrees. Record delinquencies and half of recent graduates working in jobs where a massively expensive degree is not being used does not bode well for higher ed at the moment. No one has a crystal ball on how this will play out but you can rest assured that something is going to give. You don’t need a college degree to figure that one out.

No comments:

Post a Comment